Tesla Stock Price: The Ultimate Guide To Understanding Tesla's Market Performance

Hey there, fellow investors and tech enthusiasts! If you're reading this, chances are you're curious about Tesla stock price and what it means for your portfolio. Whether you're a die-hard Elon Musk fan or just someone looking to dip their toes into the stock market, Tesla is a name that's impossible to ignore. In this guide, we'll break down everything you need to know about Tesla's stock, from its history to its current trends and future projections. So grab a cup of coffee (or maybe a Tesla Powerwall), and let's dive in!

Tesla stock price has been one of the most talked-about topics in the financial world over the past few years. The company's rapid rise in value has turned it into a household name, not just for car enthusiasts but also for investors looking to capitalize on the electric vehicle (EV) revolution. But what exactly drives Tesla's stock performance? Is it worth investing in, or is it just another bubble waiting to burst?

Now, before we get into the nitty-gritty, let's address the elephant in the room. Tesla isn't just a car company anymore. It's a tech giant that's disrupting multiple industries, from energy storage to artificial intelligence. And that's exactly why its stock price is such a big deal. So, buckle up (pun intended), because we're about to take a deep dive into the world of Tesla stock!

- Unlock The Magic A Comprehensive Guide To Laci Witton

- Unveiling The Power Of The Eur Symbol Your Ultimate Guide To Understanding And Utilizing It

Table of Contents

- Tesla's Stock Price History

- Tesla's Current Stock Price

- Factors Affecting Tesla Stock Price

- Tesla's Impact on the Stock Market

- Future Projections for Tesla Stock

- Risks Associated with Tesla Stock

- Is Tesla Stock Worth Investing In?

- Key Tesla Stock Data

- Tesla vs. Other EV Companies

- Conclusion

Tesla's Stock Price History

Tesla's journey in the stock market is nothing short of remarkable. The company went public in 2010, and since then, its stock price has skyrocketed. Back in the day, you could pick up shares for less than $20. Fast forward to today, and we're talking about a stock that's worth hundreds, if not thousands, of dollars per share.

One of the key moments in Tesla's stock price history was the stock split in 2020. This move made it more accessible to retail investors, and boy, did it pay off. The split saw a surge in demand, driving the price even higher. But it's not just about the numbers. Tesla's stock price reflects the company's innovation, ambition, and Elon Musk's vision for the future.

Key Milestones in Tesla's Stock Journey

- 2010: Tesla goes public at $17 per share.

- 2013: Tesla's stock price hits $100 for the first time.

- 2020: The 5-for-1 stock split makes Tesla more accessible.

- 2021: Tesla becomes one of the most valuable automakers in the world.

Tesla's Current Stock Price

As of now, Tesla's stock price is sitting pretty at [insert current price]. But here's the thing—Tesla's stock is notoriously volatile. One day you're up, and the next day you're down. It's like riding a rollercoaster, but instead of screaming, you're checking your portfolio every five minutes.

- How Do Pillsbury Halloween Cookies Compare To Other Seasonal Cookies

- Daniel Wayne Smith Death Unraveling The Truth Behind The Headlines

What drives these fluctuations? A mix of factors, really. From quarterly earnings reports to Elon Musk's tweets, anything can send Tesla's stock price soaring—or plummeting. But despite the ups and downs, Tesla has consistently proven itself as a powerhouse in the market. And let's not forget, the company's expansion into new markets, like China, has been a major boon for its stock price.

Factors Affecting Tesla Stock Price

Tesla's stock price isn't just a random number floating around in the market. There are several factors that influence its performance. Let's break them down:

1. Financial Performance

Tesla's quarterly earnings reports are like a report card for the company. If they hit their targets—or better yet, exceed them—the stock price tends to rise. But if they miss, well, let's just say investors aren't too happy.

2. Industry Trends

The electric vehicle market is booming, and Tesla is at the forefront of it. As more countries push for greener energy solutions, Tesla's stock price benefits from the increased demand for EVs. But competition is heating up, and that could impact its market share.

3. Elon Musk's Influence

Love him or hate him, Elon Musk's words carry weight in the market. Whether it's a tweet about Bitcoin or a statement about Tesla's future plans, investors hang on his every word. Sometimes, this can be a double-edged sword, but there's no denying his impact on Tesla's stock price.

Tesla's Impact on the Stock Market

Tesla isn't just any stock—it's a game-changer. Its success has inspired a wave of EV startups and traditional automakers to pivot towards electric vehicles. And let's not forget, Tesla's inclusion in the S&P 500 was a big deal. It sent shockwaves through the market and solidified its status as a major player.

But Tesla's impact goes beyond the stock market. It's changing the way we think about transportation, energy, and even space exploration. And that's what makes it such an exciting investment opportunity. You're not just buying a stock—you're investing in the future.

Future Projections for Tesla Stock

So, what's next for Tesla stock? Analysts are divided, but one thing is clear—Tesla's potential is enormous. With plans to expand into new markets, develop cutting-edge technology, and even launch a humanoid robot, the company has plenty of room to grow.

But here's the catch: with great potential comes great risk. Tesla's stock price could continue to soar, or it could take a nosedive. The key is to stay informed and make decisions based on solid research, not just hype.

Long-Term Growth Potential

- Expansion into emerging markets.

- Innovation in autonomous driving technology.

- Growth in the energy storage sector.

Risks Associated with Tesla Stock

Let's be real—Tesla stock isn't without its risks. The company operates in a highly competitive and rapidly changing industry. Here are a few things to keep in mind:

1. Competition

Other automakers are catching up, and some are even beating Tesla in certain markets. This could put pressure on its stock price if it fails to maintain its edge.

2. Regulatory Challenges

As Tesla expands globally, it faces different regulatory environments. Any changes in policy could impact its operations and, by extension, its stock price.

3. Economic Uncertainty

Global economic conditions can also affect Tesla's stock. A recession or market downturn could lead to a decrease in demand for luxury EVs, impacting the company's financial performance.

Is Tesla Stock Worth Investing In?

That's the million-dollar question, isn't it? Whether Tesla stock is worth investing in depends on your risk tolerance and investment goals. If you're looking for a high-growth stock with the potential for big returns, Tesla could be a great choice. But if you prefer stability and predictability, it might not be the right fit.

Ultimately, the decision comes down to you. Do your research, consult with a financial advisor, and make an informed decision. And remember, investing in Tesla isn't just about the money—it's about being part of something bigger.

Key Tesla Stock Data

Here's a quick look at some key data points for Tesla stock:

| Data Point | Value |

|---|---|

| Current Stock Price | [Insert current price] |

| Market Capitalization | [Insert market cap] |

| 52-Week High | [Insert high] |

| 52-Week Low | [Insert low] |

| Dividend Yield | [Insert yield] |

Tesla vs. Other EV Companies

Tesla isn't the only player in the EV game. Companies like Rivian, Lucid Motors, and even traditional automakers like GM and Ford are making waves in the industry. But what sets Tesla apart?

For starters, Tesla has a first-mover advantage. It's been in the EV space longer than most of its competitors and has built a strong brand reputation. Additionally, its vertical integration—producing everything from batteries to software—gives it a competitive edge.

Key Competitors

- Rivian: Known for its rugged electric trucks.

- Lucid Motors: Focused on luxury EVs with long ranges.

- GM and Ford: Traditional automakers with ambitious EV plans.

Conclusion

Alright, folks, that's a wrap on our deep dive into Tesla stock price. Whether you're a seasoned investor or just starting out, Tesla offers a unique opportunity to be part of a company that's reshaping the world. But remember, with great reward comes great risk. Do your homework, stay informed, and make smart decisions.

Before you go, drop a comment and let us know what you think about Tesla stock. Are you bullish, bearish, or somewhere in between? And don't forget to share this article with your friends and family. The more, the merrier!

- Unveiling The Mysteries Of The Chinese Zodiac 2003 Element

- Instacmas The Ultimate Guide To Surviving The Festive Season On Social Media

Tesla Stock Price Prediction 2025 And 2024 Schrikkeljaar Amabel Lavena

/cdn.vox-cdn.com/uploads/chorus_asset/file/19684773/jyQV4_tesla_s_stock_price.png)

Tesla Stock Price End Of 2024 Daune Eolande

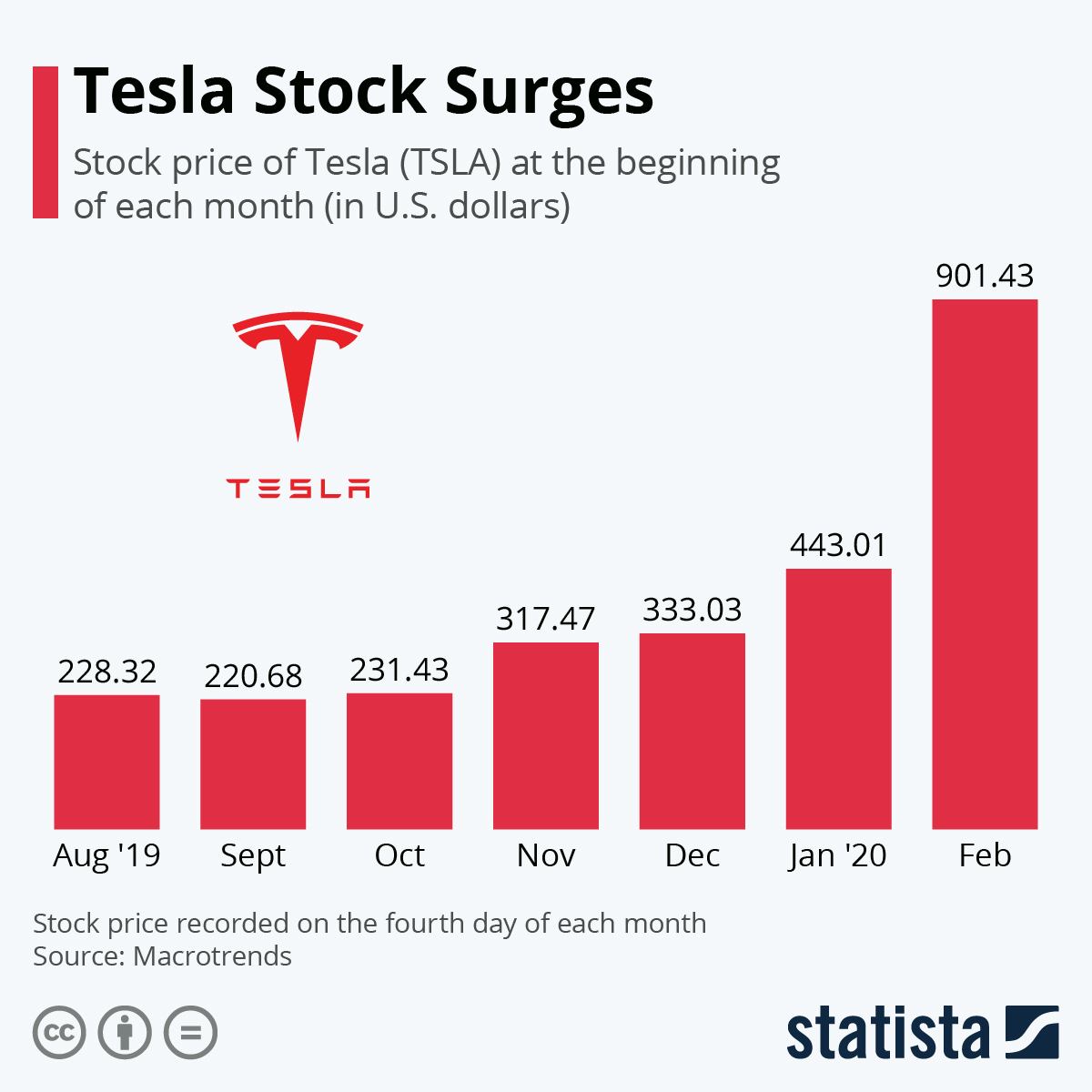

Chart Tesla Stock Surges Statista