Mortgage Rates: Your Ultimate Guide To Understanding And Securing The Best Deals

Alright, let’s cut to the chase. Mortgage rates can feel like a maze, but they don’t have to be. If you’re here, chances are you’re thinking about buying a home or refinancing an existing one. And let’s face it—mortgage rates play a massive role in determining whether you’re getting a sweet deal or stuck paying more than you should. So, buckle up, because we’re diving deep into the world of mortgage rates, breaking it all down for you in a way that’s easy to digest.

You might’ve heard people throwing around terms like “fixed-rate” or “adjustable-rate” mortgages, but what does it all mean? At its core, a mortgage rate is essentially the cost of borrowing money to buy a house. And trust me, even a tiny difference in percentage points can save—or cost—you thousands over the life of your loan. So yeah, it pays to know what you’re getting into.

Now, this isn’t just some random blog post. We’re diving into the nitty-gritty details, covering everything from how mortgage rates work to how you can score the best rates possible. Think of this as your cheat sheet to navigating the often-confusing world of home loans. Ready? Let’s go!

- Why Is Carmex Burning My Lips The Truth Behind The Tingling Sensation

- Chase Home Finance Your Ultimate Guide To Home Loans And Mortgage Solutions

Why Mortgage Rates Matter

Let’s get real for a second. Mortgage rates matter because they directly impact how much you’ll pay for your home over time. Even if you’ve got the perfect house picked out, a high mortgage rate could turn your dream home into a financial nightmare. On the flip side, snagging a low rate can make homeownership feel like a breeze.

Here’s the deal: mortgage rates are expressed as an annual percentage rate (APR), which includes both the interest rate and any additional fees associated with the loan. The lower the rate, the less you’ll pay in interest over the life of the loan. And since most mortgages last anywhere from 15 to 30 years, even a small reduction in your rate can translate into big savings.

For example, let’s say you’re borrowing $300,000 for a 30-year fixed-rate mortgage. If your rate is 5%, your total interest paid over the life of the loan would be around $279,140. But if you manage to secure a rate of 4%, that total drops to $215,609. That’s a difference of over $63,000! So yeah, mortgage rates matter—a lot.

- The Worlds Skinniest Man Unveiling The Extraordinary Story

- Eva Greens Daughter A Deep Dive Into The Life Of The Iconic Actress And Her Family

Factors That Influence Mortgage Rates

Now that we’ve established why mortgage rates matter, let’s talk about what influences them. Spoiler alert: it’s not just about your credit score (although that’s definitely a big factor). Here are some of the key things that can affect your mortgage rate:

- Economic Conditions: The overall state of the economy plays a huge role in determining mortgage rates. When the economy is strong, rates tend to rise. Conversely, during economic downturns, rates often drop.

- Federal Reserve Policies: The Fed doesn’t set mortgage rates directly, but its decisions on interest rates can influence them. When the Fed lowers rates, mortgage rates often follow suit.

- Inflation: Higher inflation typically leads to higher mortgage rates, as lenders want to ensure they’re not losing purchasing power over the life of the loan.

- Loan Type: Different types of loans come with different rates. Fixed-rate mortgages, for instance, tend to have higher rates than adjustable-rate mortgages, but they offer more stability.

- Your Credit Score: This one’s a no-brainer. A higher credit score generally means a lower mortgage rate, as lenders view you as less risky.

Types of Mortgage Rates

Not all mortgage rates are created equal. Depending on your financial situation and long-term goals, one type of mortgage rate might be better suited for you than another. Let’s break down the main types:

Fixed-Rate Mortgages

A fixed-rate mortgage means your interest rate stays the same for the entire term of the loan. This is great for people who want predictability in their monthly payments. Whether you choose a 15-year or 30-year term, you’ll know exactly how much you’ll owe each month.

Pros: Stability, predictable payments

Cons: Typically higher rates than adjustable-rate mortgages

Adjustable-Rate Mortgages (ARMs)

With an adjustable-rate mortgage, your interest rate can change over time. These loans usually start with a lower introductory rate, which can make them appealing if you’re looking to buy a home but aren’t planning to stay there long-term. After the initial period (often 5, 7, or 10 years), the rate can adjust annually based on market conditions.

Pros: Lower initial rates

Cons: Risk of rate increases, unpredictable payments

How to Get the Best Mortgage Rates

Alright, here’s the million-dollar question: how do you score the best mortgage rates? It’s not as complicated as it might seem, but it does require some legwork. Follow these tips, and you’ll be well on your way to landing a killer deal:

1. Improve Your Credit Score

Your credit score is one of the biggest factors lenders consider when determining your mortgage rate. Aim for a score of at least 740 to qualify for the best rates. Pay down debt, make payments on time, and avoid opening new credit accounts unnecessarily.

2. Shop Around

Don’t just settle for the first lender you talk to. Different lenders offer different rates, so it pays to shop around. Get quotes from multiple lenders and compare them side by side. You might be surprised at how much rates can vary.

3. Consider a Smaller Loan

The larger the loan, the higher the risk for lenders. If you can put down a larger down payment, you might qualify for a better rate. Even a 5% increase in your down payment can make a difference.

4. Lock in Your Rate

Mortgage rates can fluctuate daily, so if you find a rate you like, lock it in. A rate lock guarantees that the rate you’ve been quoted won’t change, even if market conditions shift.

Understanding APR vs. Interest Rate

Here’s where things can get a little tricky. When you’re comparing mortgage offers, you’ll often see two numbers: the interest rate and the APR. While they might seem similar, they’re actually quite different.

The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. The APR, on the other hand, includes both the interest rate and any additional fees associated with the loan, such as origination fees or discount points. Because of this, the APR is usually higher than the interest rate.

When comparing loans, it’s important to look at both numbers. The interest rate will give you an idea of your monthly payments, while the APR will give you a more complete picture of the total cost of the loan.

Common Mortgage Rate Myths

There’s a lot of misinformation out there about mortgage rates, so let’s clear up some common myths:

Myth #1: A Good Credit Score Guarantees a Low Rate

While a good credit score certainly helps, it’s not the only factor lenders consider. Other things, like your debt-to-income ratio and the size of your down payment, also play a role.

Myth #2: Fixed-Rate Mortgages Are Always Better

Not necessarily. If you’re only planning to stay in your home for a few years, an adjustable-rate mortgage might actually be a better option, as it often comes with a lower initial rate.

Myth #3: Mortgage Rates Are the Same Across the Board

Wrong. Different lenders offer different rates, so it’s important to shop around. Even a small difference in rates can add up to big savings over the life of the loan.

How Mortgage Rates Affect the Housing Market

Mortgage rates don’t just impact individual buyers; they also have a big effect on the housing market as a whole. When rates are low, more people can afford to buy homes, which drives up demand and can lead to higher home prices. Conversely, when rates are high, fewer people can afford to buy, which can lead to a slowdown in the market.

This is why it’s important to keep an eye on mortgage rates if you’re thinking about buying or selling a home. Timing your purchase or sale to coincide with favorable rates can make a big difference in your financial outcome.

What Happens When Rates Go Up?

So, what happens when mortgage rates start creeping up? For starters, it becomes more expensive to borrow money, which can make homeownership less affordable for some people. This can lead to a decrease in demand, which can in turn lead to lower home prices.

But it’s not all bad news. Higher rates can also lead to more stable housing markets, as they discourage speculation and reduce the risk of bubbles forming. And if you’re already a homeowner, a rise in rates might actually work in your favor if it increases the value of your home.

Final Thoughts

Mortgage rates might seem intimidating at first, but with a little knowledge and preparation, you can navigate them like a pro. Whether you’re buying your first home or refinancing an existing one, understanding how mortgage rates work is key to securing the best deal possible.

Remember, the key to getting a great rate is to do your homework. Improve your credit score, shop around, and don’t be afraid to negotiate. And if all else fails, lean on the expertise of a trusted mortgage professional to guide you through the process.

So, what are you waiting for? Start exploring your options today and take the first step toward homeownership—or saving big on your current mortgage. And don’t forget to drop a comment below if you’ve got any questions or tips of your own. Let’s keep the conversation going!

Table of Contents

- Why Mortgage Rates Matter

- Factors That Influence Mortgage Rates

- Types of Mortgage Rates

- How to Get the Best Mortgage Rates

- Understanding APR vs. Interest Rate

- Common Mortgage Rate Myths

- How Mortgage Rates Affect the Housing Market

- What Happens When Rates Go Up?

- Final Thoughts

- How Many Blimps Are There In The World Unveiling The Sky Giants

- Mel Metcalfe Iii A Rising Star In The World Of Entertainment And Beyond

Average Mortgage Rates as of April 3, 2025

Average US rate on a 30year mortgage dips for second drop in 2 weeks

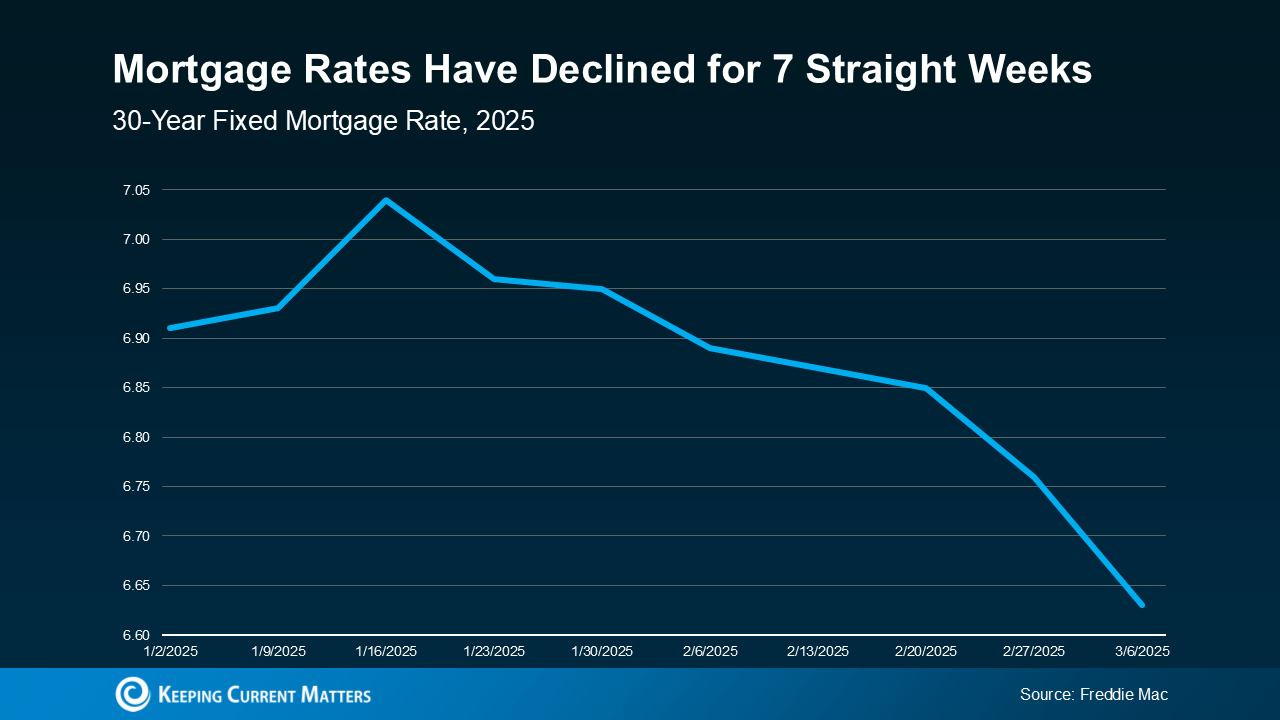

Mortgage Rates Hit Lowest Point So Far This Year Keeping Current Matters