Federal Reserve Interest Rates: The Pulse Of The Economy

Listen up, folks. The Federal Reserve interest rates are like the heartbeat of the U.S. economy. They influence everything from your mortgage payments to your retirement savings. Think about it—when the Fed tweaks these rates, it's like adjusting the thermostat for the entire financial climate. But what exactly are these rates, and why should you care? Well, buckle up because we're diving deep into the world of monetary policy, and trust me, it's more exciting than it sounds. So, whether you're a Wall Street wizard or just someone trying to make sense of their monthly bills, this is your chance to understand the driving force behind the economy's ups and downs.

Now, I know what you're thinking. "Interest rates? Really?" But hear me out. This isn't just about numbers on a spreadsheet. It's about the real-world impact on your wallet, your job, and even your dreams of buying that dream house. The Federal Reserve has a big job—balancing economic growth with stability—and interest rates are their primary tool. So, let's break it down and see how this whole thing works.

Before we dive into the nitty-gritty, let's set the stage. The Federal Reserve, often called the Fed, is like the conductor of the economic orchestra. They have their hands on the levers that control inflation, employment, and overall financial stability. And at the heart of it all? You guessed it—interest rates. So, whether you're a seasoned investor or just curious about how the economy works, this is your chance to get informed.

- Get Your Game On The Ultimate Guide To Skee Ball Machines

- Unpacking The Power Of The Symbol Of Euro More Than Just A Currency

Understanding Federal Reserve Interest Rates

Alright, let's start with the basics. What exactly are Federal Reserve interest rates? In simple terms, they're the cost of borrowing money. When the Fed adjusts these rates, it affects how much it costs banks to lend money to each other, which in turn trickles down to consumers like you and me. If rates go up, borrowing becomes more expensive, and if they go down, borrowing gets cheaper. It's like a seesaw, balancing supply and demand in the economy.

Why Are They Important?

Here's the deal: interest rates aren't just some abstract concept. They have a direct impact on your daily life. For instance, if you're looking to buy a house, the mortgage rate you get will depend heavily on the Fed's decisions. If rates are low, it's a great time to lock in a deal. But if they're high, you might need to rethink your budget. And it's not just mortgages. Credit card rates, car loans, and even savings accounts are all influenced by the Fed's moves.

The Role of the Federal Reserve

The Federal Reserve plays a crucial role in managing the U.S. economy. Their main goals are to promote maximum employment, stable prices, and moderate long-term interest rates. Think of them as the economic guardians, ensuring that the country doesn't spiral into chaos. They use a variety of tools to achieve these goals, but interest rates are their go-to weapon.

- Daniel Wayne Smith Cause Of Death Unveiling The Truth Behind The Headlines

- Joealis Filippetti The Rising Star Shaping The Future Of Entertainment

How the Fed Sets Rates

So, how exactly does the Fed decide on interest rates? It's not as simple as flipping a coin. The Federal Open Market Committee (FOMC) meets regularly to assess the state of the economy. They look at data like inflation rates, unemployment numbers, and GDP growth. Based on this information, they decide whether to raise, lower, or keep rates steady. It's a delicate balancing act, and their decisions can have ripple effects across the globe.

Historical Context of Federal Reserve Interest Rates

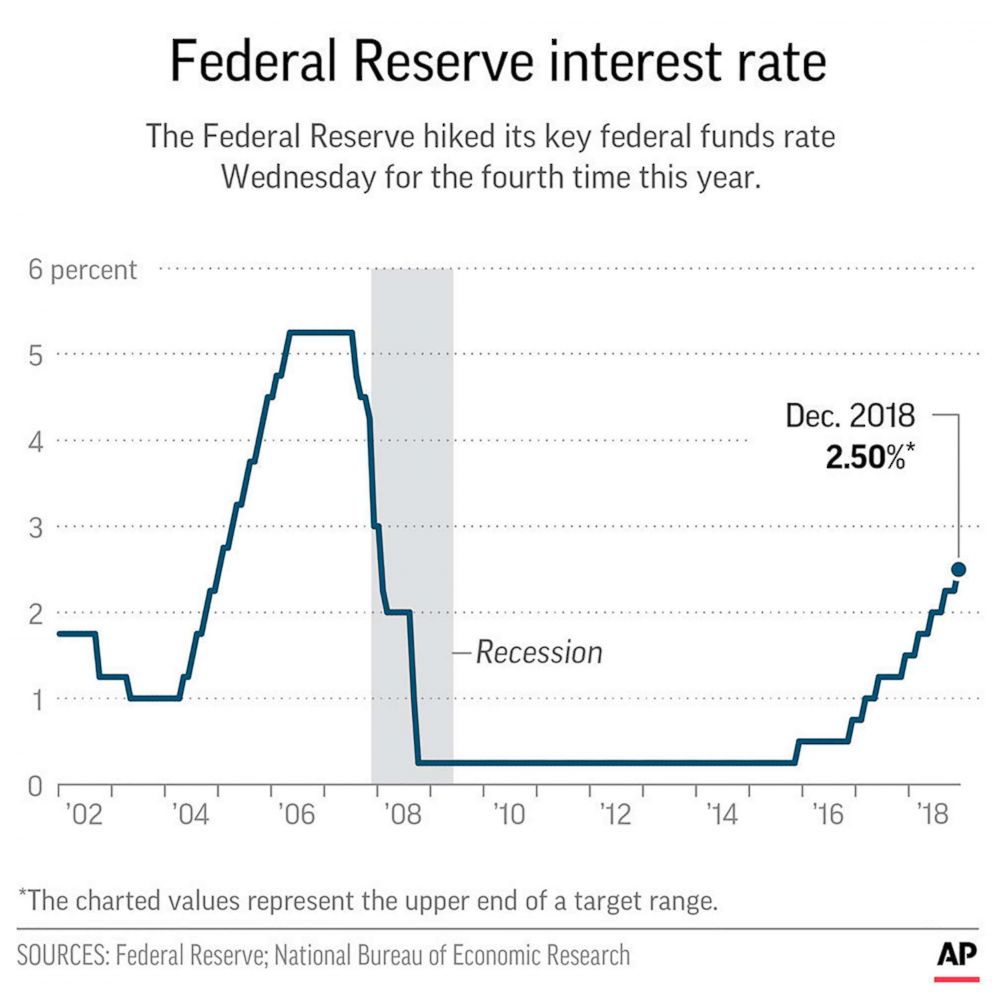

To truly understand the significance of Federal Reserve interest rates, it's important to look at their historical context. Over the years, the Fed has made some bold moves, both good and bad. For example, during the 2008 financial crisis, they slashed rates to near zero to stimulate the economy. And more recently, they've been raising rates to combat inflation. Each decision was made with the greater good in mind, but the results haven't always been perfect.

Key Moments in Fed History

- 1980s: Under Chairman Paul Volcker, the Fed raised rates dramatically to fight rampant inflation. It was painful in the short term but ultimately successful.

- 2008 Financial Crisis: The Fed dropped rates to near zero and implemented quantitative easing to stabilize the economy.

- 2020 Pandemic: In response to the global pandemic, the Fed once again lowered rates to near zero to support businesses and consumers.

Impact on the Economy

When the Fed adjusts interest rates, the effects are felt throughout the economy. For businesses, lower rates can mean more affordable loans, encouraging investment and expansion. For consumers, it can mean cheaper mortgages and car loans, boosting spending power. But on the flip side, if rates are too low for too long, it can lead to inflation, eroding the value of your money.

Effects on Inflation

Inflation is one of the Fed's biggest concerns, and interest rates are their primary tool for controlling it. When inflation rises, the Fed typically raises rates to cool down the economy. This can lead to slower growth, but it also helps prevent runaway prices. It's a trade-off, but one that's necessary for long-term stability.

How Interest Rates Affect You

Now, let's talk about how all of this affects you personally. Whether you're saving for retirement, buying a home, or just trying to make ends meet, Federal Reserve interest rates play a role. For savers, higher rates mean better returns on savings accounts and CDs. But for borrowers, it means higher costs for loans and credit cards. It's a double-edged sword, and understanding it can help you make smarter financial decisions.

Managing Debt in a Rising Rate Environment

If you have existing debt, especially variable-rate loans, rising interest rates can be a challenge. Here are a few tips to help you manage:

- Refinance: Consider refinancing your loans to lock in a lower fixed rate.

- Prioritize Payments: Focus on paying off high-interest debt first to save money in the long run.

- Budget Wisely: Adjust your budget to account for higher interest payments.

The Global Impact of Federal Reserve Rates

It's not just the U.S. economy that feels the effects of Federal Reserve interest rates. The global financial system is interconnected, and the Fed's decisions can have far-reaching consequences. For example, when the Fed raises rates, it can lead to a stronger dollar, making U.S. exports more expensive and imports cheaper. This can impact trade balances and economic growth worldwide.

How Other Countries Respond

Central banks around the world closely monitor the Fed's actions and often adjust their own policies in response. For instance, if the Fed raises rates, other countries might follow suit to prevent capital outflows. It's a complex dance, but one that highlights the interconnectedness of the global economy.

Future Trends in Federal Reserve Policy

Looking ahead, the Federal Reserve faces new challenges and opportunities. With inflation still a concern and the economy recovering from the pandemic, the path forward is uncertain. Some experts predict that rates will continue to rise gradually, while others believe the Fed may need to pivot if economic conditions change.

Key Factors to Watch

- Inflation Data: Keep an eye on inflation numbers, as they'll heavily influence the Fed's decisions.

- Employment Reports: Strong job growth could signal the Fed to keep rates steady or even raise them.

- Global Events: Geopolitical tensions and other global factors can also impact the Fed's policies.

Conclusion

In conclusion, Federal Reserve interest rates are the heartbeat of the economy, influencing everything from your mortgage to your retirement savings. Understanding how they work and why they matter can empower you to make better financial decisions. Whether you're a business owner, a homeowner, or just someone trying to make ends meet, staying informed is key.

So, what's next? Take a moment to reflect on how these rates impact your life and consider what steps you can take to prepare for future changes. And don't forget to share this article with friends and family. Knowledge is power, and the more people understand the Fed's role, the stronger our economy will be. Thanks for joining me on this journey through the world of monetary policy. Until next time, stay sharp and keep your wallet happy!

Table of Contents

- Understanding Federal Reserve Interest Rates

- The Role of the Federal Reserve

- Historical Context of Federal Reserve Interest Rates

- Impact on the Economy

- How Interest Rates Affect You

- The Global Impact of Federal Reserve Rates

- Future Trends in Federal Reserve Policy

- Conclusion

- The Worlds Skinniest Man Unveiling The Extraordinary Story

- Lisa Loiacono The Rising Star Of Motocross And Her Incredible Journey

Fed Interest Rates 2025 Forecast Usa Images References Robert S

Fed Ushers In Fourth Jumbo Increase in Interest Rates to Fight

Federal Reserve Raising Interest Rates Personal Finance Club