Social Security Checks: Your Ultimate Guide To Protecting What's Yours

Let’s face it, folks—social security checks are more than just a number on your paycheck. They’re a lifeline, a safety net that ensures you can live comfortably when you retire or face unexpected challenges. But here’s the thing: not everyone understands how this system works, and that’s where we come in. In this article, we’ll break it down for you, no BS, just the facts you need to protect your future.

Imagine this: you’ve worked hard all your life, paid your dues, and now you’re counting on Uncle Sam to keep his promise. But wait—how do you know everything’s legit? That’s where social security checks come into play. It’s like a personal audit, but instead of stressing over it, we’re gonna help you make sense of it all.

Now, before we dive deep into the nitty-gritty, let’s get one thing straight—this isn’t just another boring article. We’re here to give you actionable insights, tips, and tricks to ensure your social security is in check. So grab a cup of coffee, sit back, and let’s get started!

- Unleashing The Fury Wolverine Photo Meme Ndash The Ultimate Guide

- Famous People With Dentures Unveiling The Stars Behind The False Teeth

What Are Social Security Checks Anyway?

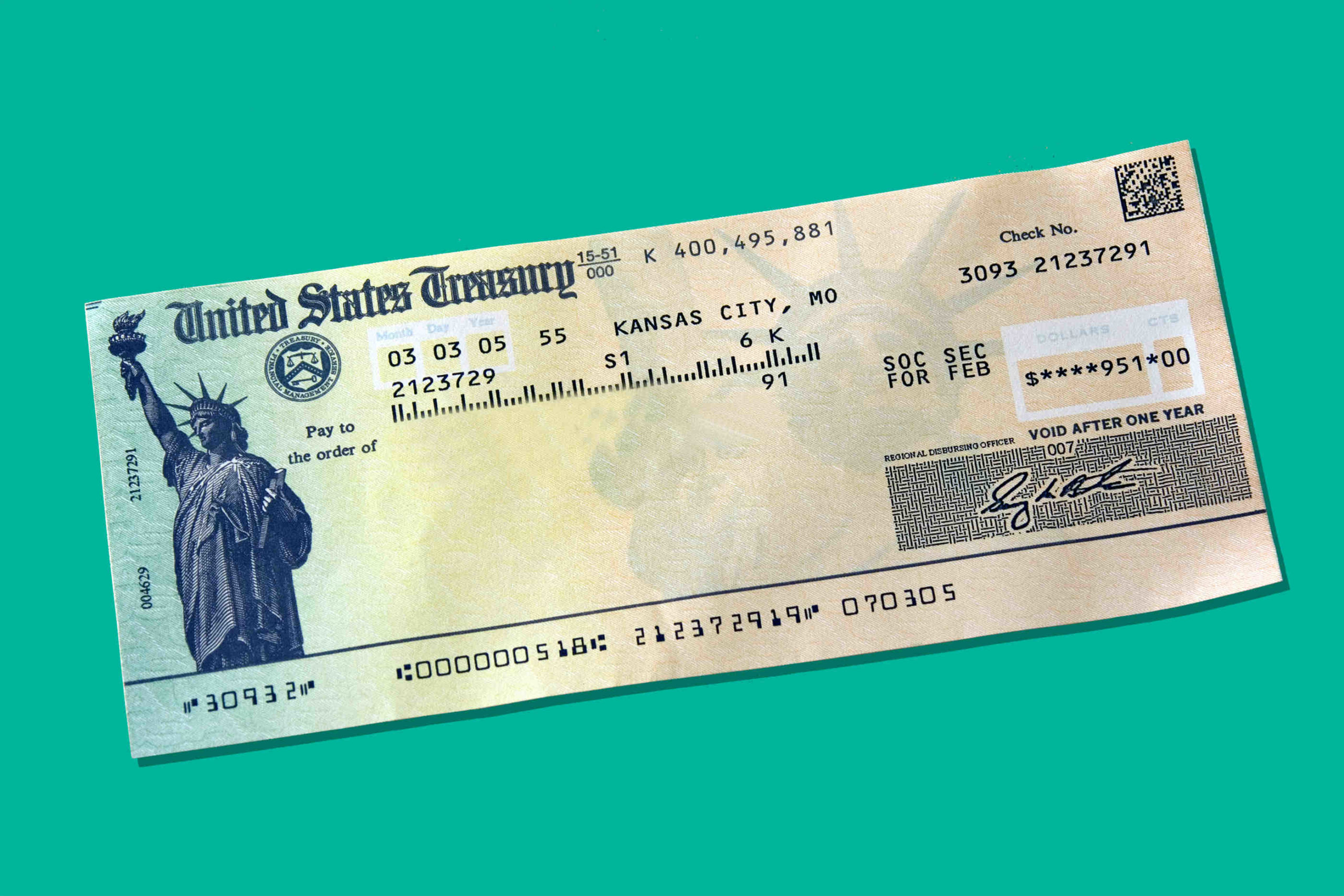

Alright, so what exactly are we talking about here? Social security checks, in a nutshell, are periodic reviews conducted by the Social Security Administration (SSA) to ensure your records are accurate and up-to-date. Think of it as a financial health check for your retirement fund.

Here’s the deal: the SSA keeps track of every penny you earn and the taxes you pay into the system. Over time, these contributions determine how much you’ll receive when you retire or if you become disabled. But sometimes, mistakes happen—and that’s where checks come in handy.

Why Do Social Security Checks Matter?

Let’s be real—no one wants to find out they’ve been shortchanged when they’re ready to kick back and enjoy life. Social security checks matter because they help catch errors early, whether it’s a typo in your earnings record or someone trying to steal your identity.

- How Many Blimps Are Floating Around The World Today

- Why The Euro Currency Symbol Matters More Than You Think

Here’s a quick rundown of why these checks are crucial:

- They verify your earnings and contributions.

- They detect and prevent fraud or identity theft.

- They ensure you receive the benefits you’re entitled to.

- They help you plan for the future with confidence.

How Often Are Social Security Checks Performed?

Now, you might be wondering—how often does this magic happen? Well, the SSA doesn’t have a fixed schedule for checks, but they do conduct periodic reviews based on certain triggers. For example, if there’s a sudden spike in your earnings or a change in your employment status, it might prompt a review.

Additionally, the SSA sends out an annual statement to workers aged 60 and above, summarizing their earnings and projected benefits. It’s like a yearly report card for your financial future.

Common Issues Found During Social Security Checks

Even the best systems aren’t immune to glitches. During social security checks, the SSA often uncovers issues such as:

- Inaccurate earnings reports due to clerical errors.

- Unreported income from side gigs or freelance work.

- Potential identity theft or fraudulent activity.

- Discrepancies in personal information, like name changes or date of birth.

Spotting these issues early can save you a lot of headaches down the road, so it’s worth keeping an eye on your records.

How to Request a Social Security Check

If you suspect something’s off with your records, don’t wait for the SSA to catch it. You can request a manual review by following these steps:

- Create an account on the official SSA website.

- Review your earnings history and compare it to your tax records.

- Report any discrepancies directly to the SSA.

- Follow up with the agency to ensure your issue is resolved.

It’s as simple as that, folks. Taking the initiative can make all the difference in securing your financial future.

Protecting Your Social Security Information

Identity theft is real, and it can wreak havoc on your social security records. To keep your info safe, follow these tips:

- Shred sensitive documents before disposing of them.

- Avoid sharing your Social Security Number (SSN) unless absolutely necessary.

- Monitor your credit reports for suspicious activity.

- Enable two-factor authentication on your online accounts.

By staying vigilant, you can minimize the risk of someone hijacking your benefits.

Understanding Your Social Security Benefits

So, you’ve made it this far—now let’s talk about the good stuff: your benefits. Social security benefits come in different flavors, depending on your situation:

Retirement Benefits

These are the big ones—payments you receive after retiring at your full retirement age. The amount depends on your lifetime earnings and the age at which you start claiming benefits.

Disability Benefits

If you become unable to work due to a medical condition, disability benefits can help cover your expenses. Eligibility is based on your work history and the severity of your condition.

Survivor Benefits

These benefits provide financial support to your family if you pass away. Eligible survivors include spouses, children, and dependent parents.

Knowing your options can help you plan for various life scenarios and make the most of your social security contributions.

How Social Security Checks Impact Your Benefits

Here’s the kicker: the accuracy of your social security records directly affects the benefits you receive. If there’s a mistake in your earnings history, it could result in lower payments—or worse, no payments at all.

That’s why regular checks are so important. By catching errors early, you can ensure your benefits reflect your true contributions and needs.

Debunking Myths About Social Security Checks

There’s a lot of misinformation floating around about social security checks. Let’s clear up some common myths:

- Myth: Social security checks are only for retirees.

Fact: Anyone can request a review, regardless of age or employment status. - Myth: The SSA will automatically fix errors without your input.

Fact: While the SSA does its best, it’s up to you to report any discrepancies. - Myth: Social security checks are invasive and time-consuming.

Fact: Most reviews are quick and painless, especially if you have your records organized.

Armed with the truth, you can approach social security checks with confidence.

Resources for Further Assistance

Still have questions? No worries—we’ve got you covered. Here are some resources to help you navigate the world of social security:

- Social Security Administration: The official website for all things social security.

- AARP: A wealth of information for retirees and pre-retirees.

- IRS: For help with tax-related issues affecting your social security contributions.

These sites offer valuable tools and guidance to help you stay informed and proactive.

Final Thoughts: Taking Control of Your Social Security Future

There you have it, folks—a comprehensive guide to social security checks. By understanding how the system works and staying on top of your records, you can ensure your future is secure.

So, what’s next? We encourage you to take action today. Check your social security statement, report any issues, and stay informed about changes to the system. And don’t forget to share this article with friends and family who could benefit from the knowledge.

Together, we can make social security work for everyone. Thanks for reading, and remember—your future is worth protecting!

Table of Contents

- What Are Social Security Checks Anyway?

- Why Do Social Security Checks Matter?

- How Often Are Social Security Checks Performed?

- Common Issues Found During Social Security Checks

- How to Request a Social Security Check

- Protecting Your Social Security Information

- Understanding Your Social Security Benefits

- How Social Security Checks Impact Your Benefits

- Debunking Myths About Social Security Checks

- Resources for Further Assistance

- What Is The Euro Symbol A Comprehensive Guide To Understanding The Euro

- Rooftop Nightclub Nyc Where The Skyline Meets The Party Scene

1 800 Social Security Checks 2025 Toby L Betche

Social Security Checks Are Getting a Major Boost U.S. Money Reserve

When to Start Your Social Security Check? ToniSays