Fox Anchor: Support 401(k) Like War – Why It’s A Battle Worth Fighting For

When it comes to financial security, the battle lines are drawn, and one Fox anchor is leading the charge. The phrase "Support 401(k) Like War" has been making waves in the financial world, and it’s time we took a closer look at what this means for everyday Americans. In an era where retirement planning feels like navigating a minefield, understanding the importance of a solid 401(k) plan is crucial. This isn’t just about numbers; it’s about securing your future.

Imagine this: you’re sitting at your kitchen table, scrolling through headlines, and you come across a fiery statement from a Fox anchor. They’re not just talking about retirement; they’re calling it a war. Why? Because in today’s economy, safeguarding your financial future is as critical as any battle. This isn’t hyperbole; it’s reality. With the rising cost of living, inflation, and uncertain market conditions, your 401(k) might be the only weapon in your arsenal.

So, buckle up because we’re diving deep into the world of 401(k) plans, exploring why they matter, how to maximize them, and why supporting them is akin to waging war for your financial independence. Whether you’re just starting out or nearing retirement, this article has something for everyone. Let’s get started!

- James Taylors Children A Closer Look At The Lives Of A Musical Legacy

- Handy Tips From Homey Your Ultimate Guide To Making Life Easier

Table of Contents:

- Fox Anchor Biography

- Why 401(k) Matters

- The War Analogy

- Benefits of 401(k)

- Maximizing Your 401(k)

- Challenges in 401(k) Planning

- Effective Strategies

- Employer Match Programs

- Setting Retirement Goals

- Conclusion

Fox Anchor Biography

Before we dive into the nitty-gritty of 401(k) plans, let’s talk about the person behind the phrase. The Fox anchor who’s been vocal about supporting 401(k) plans like it’s a war is no ordinary commentator. They’ve spent decades in the financial world, analyzing trends, interviewing experts, and delivering hard-hitting commentary that resonates with millions.

Fox Anchor’s Background

Here’s a quick rundown of their credentials:

- Ed Winters Coroner The Unfiltered Story You Need To Know

- Get Your Game On The Ultimate Guide To Skee Ball Machines

| Name | [Fox Anchor's Name] |

|---|---|

| Age | [Age] |

| Career Highlights | Host of [Show Name], Former Financial Analyst, Author of [Book Title] |

| Education | Bachelor’s Degree in Economics, MBA in Finance |

| Awards | Emmy Award Winner, Recognized by Forbes as a Top Financial Commentator |

With a background like this, it’s no surprise they’re taking a stand on 401(k) plans. They’ve seen the struggles firsthand and understand the urgency of the situation.

Why 401(k) Matters

Let’s face it, folks. A 401(k) isn’t just another retirement plan; it’s a lifeline. In a world where pensions are becoming extinct, Social Security might not cover all your expenses, and healthcare costs are skyrocketing, your 401(k) could be the difference between living comfortably and struggling to make ends meet.

Key Facts About 401(k) Plans

- More than 60 million Americans participate in 401(k) plans.

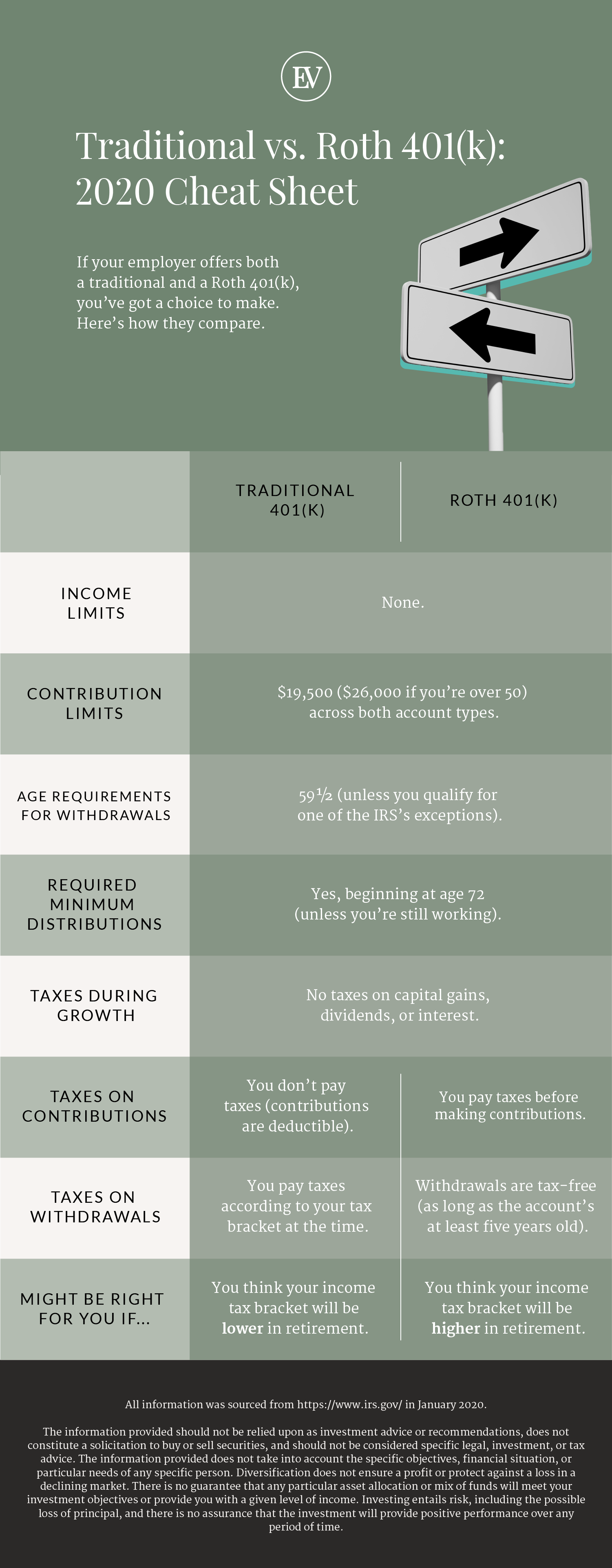

- Contributions are made pre-tax, reducing your taxable income.

- Many employers offer matching contributions, essentially giving you free money.

- Investment options vary, allowing you to tailor your portfolio to your risk tolerance.

Think of your 401(k) as a shield in this financial war. Without it, you’re vulnerable to the unpredictable forces of the market and the ever-increasing cost of living.

The War Analogy

Now, let’s break down why the phrase "Support 401(k) Like War" is so powerful. Wars are fought for a reason, right? Whether it’s defending your homeland, protecting your values, or securing your future, wars require strategy, resources, and unwavering commitment. The same principles apply to your 401(k).

Key Strategies in the Financial War

- Education: Know your options, understand the terms, and stay informed about market trends.

- Investment: Allocate your resources wisely, diversify your portfolio, and take calculated risks.

- Defense: Protect your assets from inflation, market downturns, and unexpected expenses.

Just like any war, you need a solid plan and the right tools to win. Your 401(k) is your primary weapon in this battle, and neglecting it is akin to surrendering without a fight.

Benefits of 401(k)

Okay, so we’ve established that a 401(k) is important, but let’s talk specifics. What exactly are the benefits of having one? Here’s a breakdown:

- Tax Advantages: Contributions are made pre-tax, which lowers your taxable income.

- Compound Interest: Over time, your investments grow exponentially, thanks to the power of compound interest.

- Employer Contributions: Many employers match a percentage of your contributions, which is essentially free money.

- Versatility: You can choose from a variety of investment options, allowing you to customize your portfolio.

These benefits aren’t just theoretical; they’re real, tangible advantages that can make a significant difference in your financial future.

Maximizing Your 401(k)

So, you’ve got a 401(k) plan. Great! But how do you make the most of it? Here are some tips:

Top Tips for Maximizing Your 401(k)

- Contribute Early and Often: The earlier you start contributing, the more time your money has to grow.

- Take Advantage of Employer Matches: If your employer offers a match, contribute at least enough to get the full match.

- Rebalance Regularly: As your financial situation and market conditions change, rebalance your portfolio to maintain your desired risk level.

- Stay Informed: Keep up with market trends and adjust your strategy accordingly.

Maximizing your 401(k) isn’t rocket science, but it does require a bit of effort and discipline. Think of it like training for a marathon; the more you prepare, the better your chances of success.

Challenges in 401(k) Planning

Of course, no battle is without its challenges. When it comes to 401(k) planning, there are several obstacles to overcome:

Common Challenges

- Market Volatility: The stock market can be unpredictable, and your investments may fluctuate in value.

- High Fees: Some 401(k) plans come with high administrative fees, which can eat into your returns.

- Lack of Knowledge: Many people don’t fully understand how 401(k) plans work, leading to poor decision-making.

But here’s the thing: every challenge has a solution. By educating yourself, shopping around for plans with lower fees, and seeking professional advice when needed, you can overcome these hurdles.

Effective Strategies

Now, let’s talk strategies. How do you navigate the financial battlefield and emerge victorious? Here are some effective strategies to consider:

Strategies for Success

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes.

- Set Clear Goals: Know what you want to achieve with your 401(k) and create a plan to get there.

- Review Regularly: Regularly review your 401(k) plan to ensure it aligns with your goals and adjust as needed.

These strategies aren’t just suggestions; they’re battle-tested tactics that can help you win the war for your financial future.

Employer Match Programs

One of the biggest advantages of 401(k) plans is the potential for employer matches. Think of it this way: if your employer offers a match, they’re essentially giving you free money. Why would you turn that down?

How Employer Matches Work

Here’s how it typically works: your employer will match a percentage of your contributions, up to a certain limit. For example, they might match 50% of your contributions up to 6% of your salary. That means if you contribute 6% of your salary, your employer will add an additional 3%. It’s like getting a bonus just for saving for your future.

Take advantage of this opportunity. If your employer offers a match, contribute at least enough to get the full match. It’s one of the easiest ways to boost your retirement savings.

Setting Retirement Goals

Finally, let’s talk about setting retirement goals. What do you want your retirement to look like? Do you want to travel the world, spend more time with family, or pursue a passion project? Whatever your goals are, your 401(k) can help you get there.

Steps to Setting Retirement Goals

- Define Your Vision: Picture your ideal retirement and write it down.

- Estimate Your Needs: Calculate how much money you’ll need to achieve your vision.

- Create a Plan: Develop a plan to save and invest accordingly.

Remember, your retirement goals are personal to you. Don’t let anyone else dictate what your future should look like. Take control of your financial destiny and make your 401(k) work for you.

Conclusion

As we wrap up this article, let’s recap the key points. Supporting your 401(k) like it’s a war isn’t just a catchy phrase; it’s a call to action. Your financial future depends on the decisions you make today, and your 401(k) is one of the most powerful tools at your disposal.

We’ve covered why 401(k) plans matter, the benefits they offer, the challenges you might face, and strategies for success. We’ve also talked about employer matches and setting retirement goals. Now it’s your turn to take action.

So, what are you waiting for? Start contributing to your 401(k) today, educate yourself about your options, and stay committed to your financial goals. And remember, the battle for your financial future is one worth fighting for.

Got thoughts or questions? Drop a comment below, share this article with your friends, or check out our other articles for more financial insights. Let’s win this war together!

- Is Destiny 2 Down The Ultimate Guide To Server Status Fixes And Everything You Need To Know

- The Skinniest Person Unveiling The Extraordinary Journey

Fox Anchor Support 401(k) Like War A Comprehensive Analysis

Fox Anchor Support 401(k) Like War A Comprehensive Analysis

Fox Anchor Support 401(k) Like War A Comprehensive Analysis