Chase Pre-Approval Mortgage: Your Key To Unlocking Your Dream Home

So, you've probably heard the buzz about Chase pre-approval mortgage, right? If you're thinking about buying a home or just trying to get your financial ducks in a row, this is the game-changer you need to know about. A pre-approval mortgage from Chase isn't just some paperwork—it's like having a golden ticket to the home-buying world. It tells sellers and real estate agents that you're serious, financially ready, and not just another tire-kicker. So, yeah, it's kind of a big deal.

But hold up—what exactly does it mean to get pre-approved for a mortgage? Think of it as the bank saying, "Hey, we've looked at your financials, and we're cool with lending you a certain amount of money for a house." It's not the final loan approval, but it's a strong indicator that you're on the right track. And when it comes to Chase, they're known for being legit and having solid options for homebuyers.

Now, before we dive deep into the nitty-gritty of Chase pre-approval mortgages, let's talk about why you're here. Maybe you're scrolling through your phone late at night, dreaming about that perfect kitchen or backyard oasis. Or maybe you're just trying to figure out if now's the right time to make a move. Either way, understanding the pre-approval process can save you a ton of stress and help you make smarter decisions. Stick around, and we'll break it all down for you.

- How Do Pillsbury Halloween Cookies Compare To Other Seasonal Cookies

- What Is The Euro Symbol A Comprehensive Guide To Understanding The Euro

What Exactly is a Chase Pre-Approval Mortgage?

Alright, let's get real for a sec. A Chase pre-approval mortgage is basically the bank giving you a heads-up on how much they're willing to lend you for your dream home. It's like having a budget in your pocket before you even start house hunting. When you get pre-approved, Chase takes a good look at your credit score, income, debt-to-income ratio, and other financial factors to figure out what you can afford.

And here's the kicker—this isn't just some casual estimate. A pre-approval is a more serious commitment than a pre-qualification. It involves a deeper dive into your finances, and Chase will actually pull your credit report to verify everything. So, yeah, it's legit. And having that pre-approval letter in hand can make all the difference when you're competing with other buyers.

Why Chase Stands Out in the Pre-Approval Game

Now, you might be wondering, "Why should I go with Chase?" Well, for starters, Chase is one of the biggest and most trusted banks out there. They've been around for a hot minute and have a solid reputation for handling mortgages. Plus, they offer a bunch of perks, like online applications, competitive interest rates, and customer service that doesn't make you want to pull your hair out.

- Aquarius Season A Time For Innovation Rebellion And Cosmic Energy

- Top Picks For San Ramon Hotels Your Ultimate Guide To Comfort And Luxury

Another big advantage is that Chase has a ton of experience in the home lending space. They've helped millions of people buy homes, so you know they've got the process down to a science. Whether you're a first-time buyer or a seasoned pro, Chase can tailor their options to fit your needs. And let's be real—who doesn't love a bank that makes things easy?

Benefits of Getting a Chase Pre-Approval Mortgage

Here's the deal—getting a Chase pre-approval mortgage isn't just about knowing how much house you can afford. It's about putting yourself in the best possible position to snag that dream home. Sellers and real estate agents take pre-approved buyers way more seriously than those who are still figuring things out. It's like showing up to a job interview with a killer resume—it gives you an edge.

Plus, having a pre-approval can speed up the buying process. Once you find the right home, you're not wasting time waiting for the bank to crunch numbers. You're ready to roll, which is especially important in a competitive market. And let's not forget the peace of mind factor. Knowing exactly what you can afford takes a ton of stress out of the equation.

Key Benefits at a Glance

- Shows sellers you're a serious buyer

- Gives you a clear budget for house hunting

- Speeds up the closing process

- Helps you negotiate with confidence

- Reduces stress during the buying process

How to Get a Chase Pre-Approval Mortgage

Alright, so you're sold on the idea of getting pre-approved. But how do you actually go about doing it? The process is pretty straightforward, but there are a few key steps you need to follow. First off, you'll need to gather some important documents. Chase will want to see things like your pay stubs, tax returns, bank statements, and proof of any other income you might have.

Once you've got all your ducks in a row, you can start the application process. Chase offers both online and in-person options, so you can choose what works best for you. During the application, you'll need to provide all the info they request and authorize them to check your credit. After that, it's just a matter of waiting for their decision. If everything checks out, you'll get your pre-approval letter, and you're good to go.

Documents You'll Need

- Pay stubs from the last 30 days

- Tax returns from the past two years

- Bank statements for the last two months

- Proof of any additional income (e.g., bonuses, alimony)

- Identification (driver's license or passport)

Factors That Impact Your Pre-Approval

Let's talk about the factors that can make or break your Chase pre-approval. Your credit score is probably the biggest one. Chase typically looks for a score of at least 620 for conventional loans, but the higher your score, the better your chances of getting a favorable interest rate. Your debt-to-income ratio is another biggie. If you're already carrying a ton of debt, it might be harder to get approved—or you might end up with a lower loan amount.

Your employment history also plays a role. Chase likes to see stability, so if you've been hopping from job to job, it could raise some red flags. And don't forget about your down payment. The more you can put down, the better your chances of getting approved and scoring a better rate.

Key Factors to Keep in Mind

- Credit score (aim for 620+)

- Debt-to-income ratio (try to keep it under 43%)

- Employment history (show stability)

- Down payment amount (bigger is better)

Common Misconceptions About Chase Pre-Approval Mortgages

There are a few myths floating around about pre-approvals that we need to clear up. One of the biggest is that getting pre-approved means you're guaranteed to get the loan. Nope. A pre-approval is just a strong indication, not a guarantee. Another common misconception is that you have to buy a house right away once you're pre-approved. Wrong again. Your pre-approval is usually good for 90 days, but you can always reapply if you need more time.

And here's one that really drives me nuts—people think that shopping around for mortgage rates will hurt their credit. Not true. As long as all the inquiries happen within a 14-day window, they're treated as a single inquiry. So don't be afraid to shop around and get the best deal possible.

How Chase Pre-Approval Compares to Other Lenders

When it comes to pre-approval mortgages, Chase stacks up pretty well against the competition. They offer competitive interest rates, a user-friendly application process, and a ton of resources for homebuyers. But like anything, there are pros and cons to consider. On the plus side, Chase has a massive network of branches and ATMs, which can be super convenient if you're already a Chase customer.

On the downside, some people find their customer service a bit hit-or-miss. And if you're not already in the Chase ecosystem, opening accounts or setting up automatic payments might feel like a bit of a hassle. But overall, Chase is a solid choice for anyone looking to get pre-approved for a mortgage.

Comparison Chart

| Factor | Chase | Other Lenders |

|---|---|---|

| Interest Rates | Competitive | Varies |

| Application Process | Easy and Convenient | Depends on Lender |

| Customer Service | Generally Good | Mixed Reviews |

| Branch Availability | Wide Network | Varies |

Tips for Maximizing Your Chase Pre-Approval

Now that you know the ins and outs of Chase pre-approval mortgages, here are a few tips to help you make the most of the process. First, clean up your credit report before applying. Dispute any errors and pay down any outstanding debts. It might seem like a hassle, but it can make a huge difference in your approval chances and interest rate.

Second, be honest with yourself about what you can afford. Just because Chase says you can borrow $500,000 doesn't mean you should. Factor in things like property taxes, insurance, and maintenance costs when setting your budget. And finally, don't be afraid to ask questions. Your Chase mortgage specialist is there to help, so lean on them if you're unsure about anything.

Pro Tips for Success

- Check and improve your credit score

- Set a realistic budget

- Ask lots of questions

- Shop around for the best rates

Conclusion: Take the First Step Toward Your Dream Home

Alright, we've covered a lot of ground here. Chase pre-approval mortgages can be a game-changer for anyone looking to buy a home. They give you clarity, confidence, and a competitive edge in the home-buying market. But remember, getting pre-approved is just the first step. From there, it's all about finding the right home, negotiating the best deal, and closing the deal.

So, what are you waiting for? If you're ready to take the plunge, head over to Chase's website or stop by a local branch to start the process. And don't forget to share this article with anyone else who might be thinking about buying a home. The more people know about Chase pre-approval mortgages, the better off we all are. Now go out there and make your dream home a reality!

Table of Contents

- What Exactly is a Chase Pre-Approval Mortgage?

- Why Chase Stands Out in the Pre-Approval Game

- Benefits of Getting a Chase Pre-Approval Mortgage

- How to Get a Chase Pre-Approval Mortgage

- Documents You'll Need

- Factors That Impact Your Pre-Approval

- Key Factors to Keep in Mind

- Common Misconceptions About Chase Pre-Approval Mortgages

- How Chase Pre-Approval Compares to Other Lenders

- Tips for Maximizing Your Chase Pre-Approval

- Pro Tips for Success

- How Old Is Rory In Season 3 A Deep Dive Into The Age Mystery

- Destiny 2 Servers The Ultimate Guide For Players In 2023

Mortgage Preapprovals

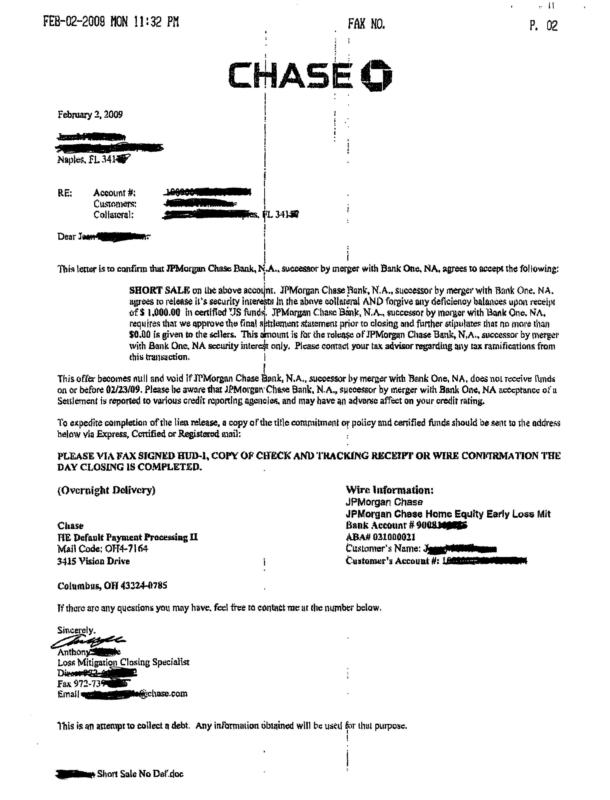

LENDER SHORT SALE ACCEPTANCE LETTER EXAMPLES READ WITH CAUTION!

Short Sale Approval Letters and What is a Short Sale