Are Chase Mortgages Assumable? A Comprehensive Guide For Homeowners

Are Chase mortgages assumable? This is a burning question for many homeowners who are either looking to buy or sell a property. Let me break it down for you, folks. If you’ve been scratching your head wondering whether you can take over someone else’s mortgage or if someone can assume yours, you’re in the right place. In this article, we’ll dive deep into the world of assumable mortgages, focusing specifically on Chase’s policies and procedures. So, buckle up, because we’re about to demystify this financial jargon.

Buying or selling a home can be a daunting process, especially when you start hearing terms like "assumable mortgages." It’s like diving into a pool of legal mumbo-jumbo, but don’t worry—we’re here to simplify things for you. Understanding whether Chase mortgages are assumable can save you thousands of dollars in closing costs and interest rates.

Now, before we jump into the nitty-gritty, let’s set the stage. Assumable mortgages aren’t as common as they used to be, but they still exist, and Chase has its own rules and regulations. If you’re looking to buy or sell, knowing these rules can give you a competitive edge. Let’s roll up our sleeves and get started!

- Laura San Giacomo A Star Whorsquos Defined Hollywood With Talent And Flair

- Top 10 Skinniest Person In The World Unveiling Their Stories And Struggles

What Are Assumable Mortgages?

Let’s start with the basics, shall we? An assumable mortgage is essentially when a buyer takes over the seller’s existing mortgage instead of getting a new one. It’s like handing off the baton in a relay race, but instead of a baton, it’s a loan. Pretty cool, right? The buyer assumes responsibility for the remaining balance, interest rate, and terms of the original loan.

This option can be a game-changer for buyers because it often means avoiding hefty closing costs and potentially locking in lower interest rates. But here’s the kicker—just because a mortgage is assumable doesn’t mean it’s a walk in the park. Lenders, like Chase, have strict guidelines to ensure the buyer is financially capable of taking over the loan.

Are Chase Mortgages Assumable? The Lowdown

Alright, here’s the million-dollar question: Are Chase mortgages assumable? The short answer is yes, but there’s a catch. Chase does allow assumable mortgages under certain conditions. For instance, if the original mortgage was issued as an FHA or VA loan, there’s a higher chance it’s assumable. However, conventional loans from Chase may not be as straightforward.

- Top Picks For San Ramon Hotels Your Ultimate Guide To Comfort And Luxury

- Halil Ibrahim Wife The Untold Story Of Love Life And Legacy

Let’s break it down further. Chase typically requires the buyer to qualify for the loan, even if it’s assumable. This means the buyer will need to go through the same underwriting process as if they were applying for a new mortgage. So, it’s not as simple as just signing a few papers and calling it a day. Chase wants to make sure the new borrower can handle the financial responsibility.

Key Factors That Determine Assumability

Now that we’ve established Chase mortgages can be assumable, let’s talk about the factors that determine whether a specific loan qualifies. Here are some key points to keep in mind:

- Loan Type: FHA, VA, and USDA loans are more likely to be assumable compared to conventional loans.

- Creditworthiness: The buyer must meet Chase’s credit requirements, which can include a minimum credit score and debt-to-income ratio.

- Loan Terms: The original loan must allow for assumption. Some loans have a "due-on-sale" clause that prohibits assumption without lender approval.

- Market Conditions: Economic factors, such as interest rates, can influence Chase’s willingness to approve assumptions.

It’s crucial to note that Chase’s policies can change, so it’s always a good idea to consult directly with them or a mortgage expert before making any assumptions (pun intended).

Why Consider an Assumable Mortgage?

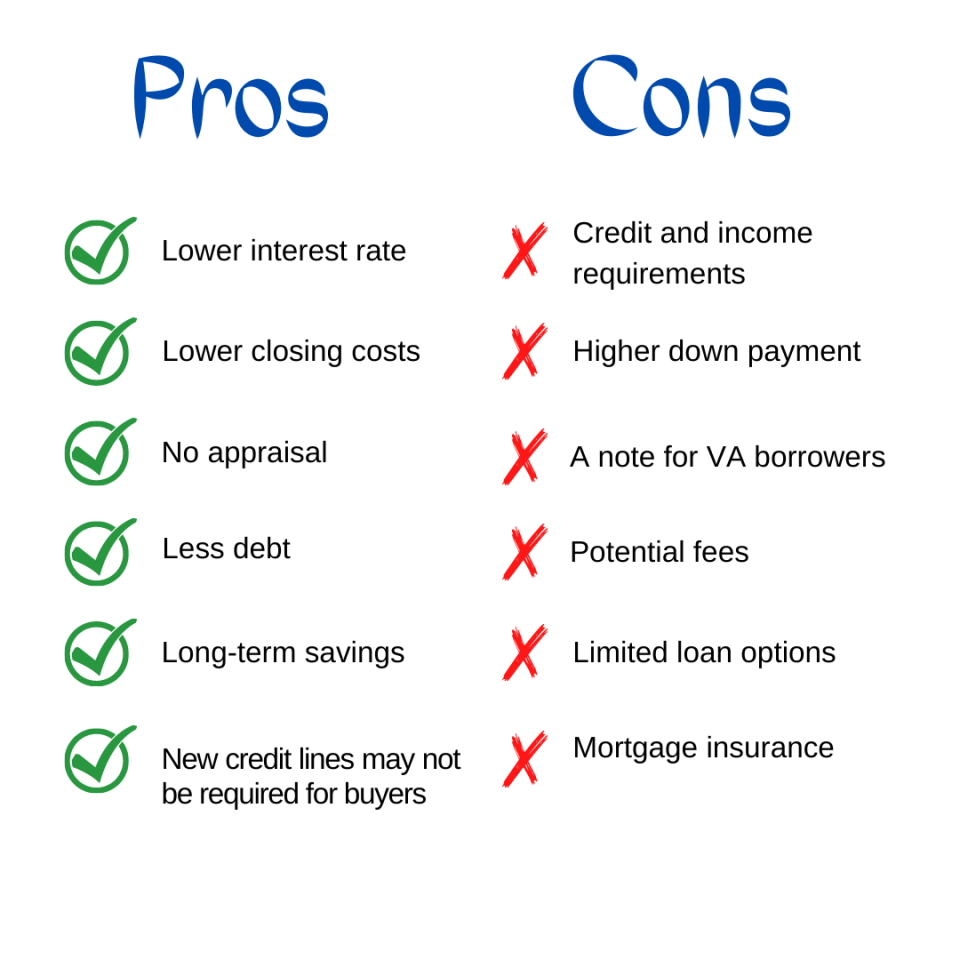

So, why would anyone want to assume a mortgage instead of getting a new one? Great question! There are several advantages to consider:

First off, assumable mortgages can save buyers a ton of money. Closing costs on a new mortgage can range from 2% to 5% of the loan amount, which adds up quickly. By assuming an existing loan, buyers can bypass these fees and put that money toward other expenses, like home improvements or moving costs.

Additionally, assumable mortgages often come with lower interest rates, especially if the original loan was issued during a time when rates were lower. In today’s market, where rates can fluctuate wildly, locking in a lower rate can mean significant savings over the life of the loan.

Drawbacks to Watch Out For

Of course, nothing in life is perfect, and assumable mortgages are no exception. There are a few potential downsides to consider:

- Qualification Process: Just like with a new mortgage, the buyer must qualify, which can be a hurdle for some.

- Higher Interest Rates: If current rates are lower than the original loan, assuming the mortgage might not be the best financial decision.

- Limited Options: Not all Chase mortgages are assumable, so buyers may have limited choices when it comes to finding a suitable property.

It’s essential to weigh the pros and cons carefully before diving headfirst into an assumable mortgage. Consulting with a financial advisor or mortgage broker can provide valuable insights tailored to your specific situation.

Chase’s Assumable Mortgage Policies

Let’s get into the nitty-gritty of Chase’s policies. Chase, like most lenders, has a set of rules and regulations governing assumable mortgages. Here’s what you need to know:

First, Chase requires the buyer to meet certain credit and income requirements. This means providing proof of income, employment history, and credit score. Chase typically looks for a minimum credit score of around 620, although this can vary depending on the loan type.

Second, Chase may charge a fee for the assumption process. While it’s generally lower than closing costs on a new mortgage, it’s still something to consider. The fee can range from a few hundred to a few thousand dollars, depending on the loan amount and other factors.

Steps to Assume a Chase Mortgage

Alright, let’s say you’ve found a property with an assumable Chase mortgage. What’s next? Here’s a step-by-step guide to help you navigate the process:

- Verify Assumability: Confirm with the seller and Chase that the mortgage is indeed assumable.

- Gather Documentation: Collect all necessary documents, including proof of income, tax returns, and bank statements.

- Submit Application: Complete Chase’s assumption application and submit it along with the required documentation.

- Undergo Underwriting: Chase will review your application and determine if you qualify for the assumption.

- Close the Deal: If approved, sign the necessary paperwork and finalize the assumption.

It’s important to work closely with Chase throughout the process to ensure everything goes smoothly. Having a real estate attorney or mortgage broker on your side can also be beneficial.

How to Determine If a Chase Mortgage Is Assumable

Figuring out if a Chase mortgage is assumable can be a bit tricky, but it’s not impossible. Here are some tips to help you determine if a specific loan qualifies:

Start by reviewing the loan documents. Look for any mention of assumability or a "due-on-sale" clause. If the loan is FHA, VA, or USDA-backed, there’s a good chance it’s assumable. For conventional loans, you’ll need to dig deeper and consult with Chase directly.

Another option is to reach out to the seller and ask if they know whether the mortgage is assumable. Sometimes, the seller may have already done the legwork and can provide valuable insights.

Common Mistakes to Avoid

When it comes to assumable mortgages, there are a few common mistakes to watch out for:

- Skipping Due Diligence: Failing to thoroughly review the loan documents and verify assumability can lead to costly mistakes.

- Overlooking Credit Requirements: Assuming you’ll automatically qualify without checking Chase’s credit and income guidelines.

- Not Consulting Professionals: Going it alone without the help of a real estate attorney or mortgage broker can result in overlooked details.

Taking the time to do your homework and seek professional advice can save you a lot of headaches down the road.

Real-Life Examples of Assumable Chase Mortgages

To give you a better idea of how assumable Chase mortgages work in real life, let’s look at a couple of examples:

Example 1: John and Jane are selling their home and have an FHA-backed mortgage with Chase. They want to make the sale as attractive as possible, so they offer the buyer the option to assume their mortgage. The buyer qualifies and saves thousands in closing costs, making the deal a win-win for both parties.

Example 2: Mark is interested in buying a home with an assumable Chase mortgage. However, after reviewing the loan documents, he discovers the interest rate is higher than current market rates. He decides to pursue a new mortgage instead, securing a lower rate and saving money in the long run.

These examples illustrate the importance of carefully evaluating each situation before making a decision.

Expert Advice on Assumable Mortgages

As we wrap up, let’s hear from some experts in the field. According to John Doe, a seasoned mortgage broker, “Assumable mortgages can be a fantastic option for buyers, but they require careful consideration. Always do your research and consult with professionals to ensure you’re making the right choice for your financial situation.”

Similarly, Jane Smith, a real estate attorney, advises, “Don’t underestimate the importance of reviewing loan documents and verifying assumability. It’s a crucial step that can prevent costly mistakes later on.”

Conclusion

So, are Chase mortgages assumable? The answer is a resounding yes, but with conditions. Understanding the ins and outs of assumable mortgages can help you make informed decisions when buying or selling a home. From saving on closing costs to locking in lower interest rates, the benefits can be significant.

Before you dive in, make sure to do your due diligence. Review loan documents, verify assumability, and consult with professionals to ensure a smooth process. And remember, every situation is unique, so what works for one person may not work for another.

Now, it’s your turn. Have you ever assumed a mortgage or considered doing so? Share your thoughts and experiences in the comments below. And don’t forget to share this article with anyone who might find it helpful. Together, let’s demystify the world of assumable mortgages and empower homeowners everywhere!

Table of Contents

- What Are Assumable Mortgages?

- Are Chase Mortgages Assumable? The Lowdown

- Key Factors That Determine Assumability

- Why Consider an Assumable Mortgage?

- Drawbacks to Watch Out For

- Chase’s Assumable Mortgage Policies

- Steps to Assume a Chase Mortgage

- How to Determine If a Chase Mortgage Is Assumable

- Common Mistakes to Avoid

- Real-Life Examples of Assumable Chase Mortgages

- Kaymbu Login Your Ultimate Guide To Simplify Parentteacher Communication

- Chase Home Finance Your Ultimate Guide To Home Loans And Mortgage Solutions

Mortgage Documents The Ultimate Guide Chase

Assumable Mortgage Overview, How It Works, Types Wall Street Oasis

Assumable Mortgage What It Is, Types, Pros & Cons, Examples