Chase Mortgage Rate: Your Ultimate Guide To Securing The Best Deal

So, you're looking to dive into the world of mortgages, huh? Whether you're buying your first home or refinancing an existing one, understanding Chase mortgage rates is a big deal. Let's face it, a mortgage is probably the largest financial commitment you'll ever make, and getting the right rate can save you thousands—or even tens of thousands—of dollars over time. But here's the thing: not all mortgage rates are created equal. And with Chase being one of the biggest players in the game, knowing how their rates stack up is crucial.

Buying a home is more than just picking out a cute kitchen or a spacious backyard. It's about securing a solid financial foundation for yourself and your family. And when it comes to Chase mortgage rates, you need to know what you're getting into. Is it a good deal? Are there hidden fees? How do their rates compare to other banks? These are all questions that deserve answers—and we're here to give 'em to you.

Now, I know what you're thinking: "Do I really need to know all this stuff?" Trust me, you do. Understanding Chase mortgage rates isn't just about numbers—it's about making smart decisions that'll impact your future. So buckle up, because we're about to break it down in a way that even your grandma could understand. And hey, if she's in the market for a new house, maybe she'll thank you later.

- Patrick Mahomes Parents The Backbone Behind A Football Legend

- Hoodwinked Voice Actors The Talent Behind The Cunning Tales

What Exactly Are Chase Mortgage Rates?

Alright, let's start with the basics. Chase mortgage rates are the interest rates that JPMorgan Chase Bank offers on home loans. These rates can vary based on a bunch of factors, like the type of mortgage, your credit score, the down payment, and even the current state of the economy. Think of it like shopping for a car—different models come with different price tags, and the same goes for mortgages.

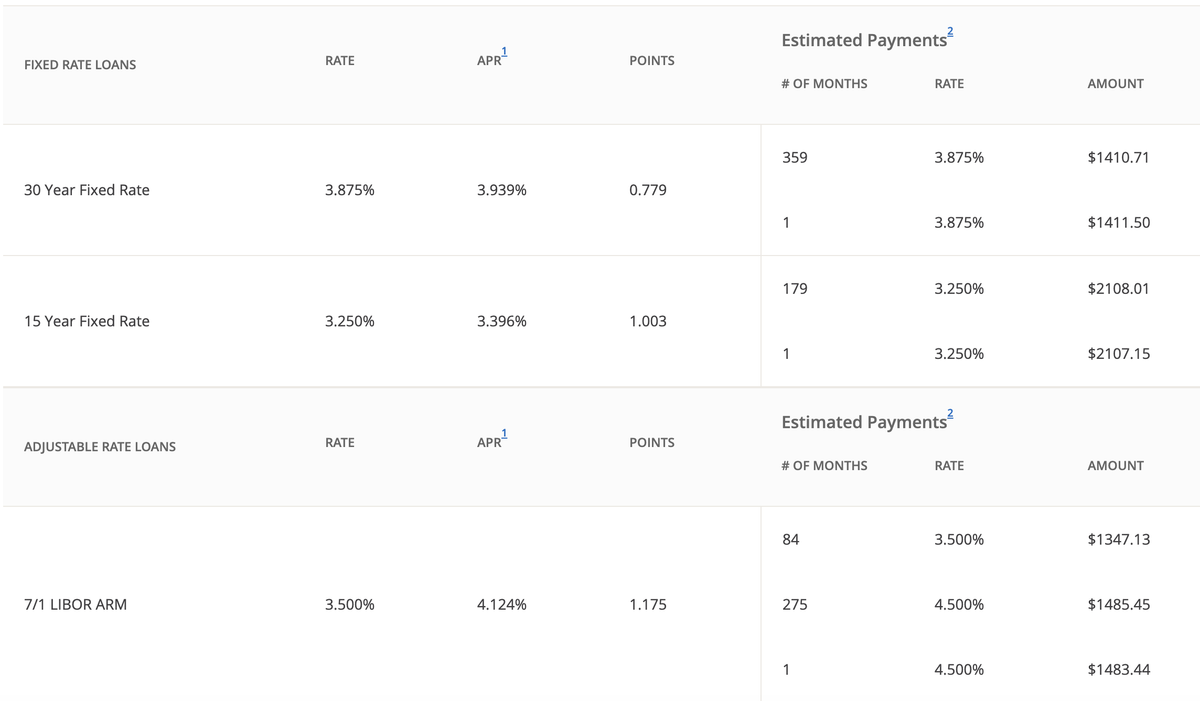

Here's the kicker: Chase isn't just offering one rate. They've got a whole menu of options, from fixed-rate mortgages to adjustable-rate mortgages (ARMs). Fixed-rate mortgages lock in your interest rate for the life of the loan, which means your monthly payments won't change. ARMs, on the other hand, start with a lower rate but can adjust after a certain period, potentially making your payments go up—or down.

And let's not forget about the fees. Yeah, there's more to it than just the interest rate. Origination fees, discount points, and closing costs can all add up. So when you're comparing Chase mortgage rates to other lenders, make sure you're looking at the big picture—not just the headline number.

- How Many Blimps Are There In The World Unveiling The Sky Giants

- Mastering European Currency Symbols Your Ultimate Guide

Why Should You Care About Chase Mortgage Rates?

Here's the deal: Chase is one of the biggest banks in the U.S., and they handle a ton of mortgages every year. If you're in the market for a home loan, chances are you've at least considered them. But why should you care about their rates specifically? Well, there are a few reasons.

First off, Chase has a reputation for being reliable. They've been around for a long time, and they've got the resources to back up their promises. Plus, they offer a wide range of mortgage products, so there's a good chance they've got something that fits your needs. But more importantly, their rates are competitive—and that's what matters most when you're shopping for a mortgage.

And let's not forget about the perks. Chase customers often get access to exclusive deals, like lower rates on certain loans or reduced fees. If you're already banking with Chase, it might make sense to stick with them for your mortgage. Just don't forget to shop around and compare their rates to other lenders before making a final decision.

Factors That Affect Chase Mortgage Rates

Okay, so we know what Chase mortgage rates are and why they're important. But here's the thing: those rates aren't set in stone. A bunch of factors can influence what you'll actually pay, and understanding these factors can help you get the best deal possible.

- Credit Score: This is a big one. The higher your credit score, the better your chances of getting a lower rate. Lenders see a good credit score as a sign that you're a responsible borrower, and they're more likely to offer you favorable terms.

- Down Payment: The more money you put down upfront, the less you'll have to borrow—and the lower your interest rate might be. A 20% down payment is the magic number for avoiding private mortgage insurance (PMI), but even putting down 10% or 15% can make a difference.

- Loan Type: Fixed-rate or adjustable-rate? 15-year or 30-year? The type of loan you choose can affect your rate. Fixed-rate loans tend to have higher rates initially, but they offer stability. ARMs might start lower, but they come with the risk of rate increases down the road.

- Economic Conditions: Believe it or not, the economy plays a role too. When the Federal Reserve lowers interest rates, mortgage rates often follow suit. And vice versa. So if you're timing your purchase right, you might be able to snag a great rate.

See? It's not just about Chase—it's about all these moving parts working together to determine your final rate. And the more you know, the better equipped you'll be to negotiate the best deal.

How Do Chase Mortgage Rates Compare to Other Lenders?

Alright, let's get real for a second. Chase isn't the only game in town. There are plenty of other lenders out there offering mortgages, and some of them might have even better rates. So how do Chase mortgage rates stack up?

Well, it depends. Chase is generally considered one of the top mortgage lenders, so their rates are usually pretty competitive. But that doesn't mean they're always the lowest. Smaller, local banks or credit unions might offer better rates on certain loans, especially if you're looking for something niche like a jumbo mortgage or an FHA loan.

And don't forget about online lenders. They often have lower overhead costs, which means they can pass those savings on to you in the form of lower rates. Plus, they might offer more flexible terms or fewer fees. So while Chase is a solid choice, it's always a good idea to shop around and compare their rates to others before making a final decision.

Key Points to Consider When Comparing Rates

When you're comparing Chase mortgage rates to other lenders, there are a few key points to keep in mind:

- APR vs. Interest Rate: The annual percentage rate (APR) includes both the interest rate and any fees associated with the loan, so it gives you a more accurate picture of the total cost.

- Loan Terms: Make sure you're comparing apples to apples. A 15-year fixed-rate loan from Chase might have a lower rate than a 30-year loan from another lender, but the monthly payments will be higher.

- Customer Service: This might not seem as important as the rate, but trust me, it is. If something goes wrong with your loan, you want to know that you can get help quickly and easily.

At the end of the day, it's not just about the rate—it's about the overall experience. Chase has a lot to offer, but make sure you're getting the best deal possible before signing on the dotted line.

Steps to Secure the Best Chase Mortgage Rate

So you've decided to go with Chase for your mortgage. Great choice! But how do you make sure you're getting the best rate possible? Here's a step-by-step guide to help you out:

Step 1: Boost Your Credit Score

Remember what we said earlier about credit scores? They're a big deal. If your score isn't where you want it to be, there are a few things you can do to improve it:

- Pay your bills on time—every time.

- Keep your credit utilization ratio low. Try to use no more than 30% of your available credit.

- Dispute any errors on your credit report. Mistakes happen, and they can hurt your score if you don't address them.

Step 2: Save for a Bigger Down Payment

The more you put down upfront, the better your chances of getting a lower rate. Plus, a bigger down payment means you'll borrow less, which can save you money in the long run.

Step 3: Shop Around and Negotiate

Don't be afraid to negotiate with Chase—or any lender, for that matter. If you find a better rate elsewhere, let them know. They might be willing to match or even beat the other offer to keep your business.

Common Questions About Chase Mortgage Rates

Let's tackle some of the most common questions people have about Chase mortgage rates:

Q: Are Chase mortgage rates fixed or variable?

A: Chase offers both fixed-rate and adjustable-rate mortgages. Fixed-rate loans lock in your interest rate for the life of the loan, while adjustable-rate loans have rates that can change after a certain period.

Q: Do Chase mortgage rates include fees?

A: Not exactly. The interest rate you see advertised is just that—the interest rate. Fees like origination fees, discount points, and closing costs are usually listed separately. That's why it's important to look at the APR, which includes both the rate and the fees.

Q: Can I lock in a Chase mortgage rate?

A: Yes, you can. Rate locks are agreements between you and the lender that guarantee a certain rate for a specified period of time. This can be especially useful if you're worried about rates going up before you close on your loan.

Expert Tips for Navigating Chase Mortgage Rates

Here are a few expert tips to help you navigate Chase mortgage rates like a pro:

- Stay Informed: Keep an eye on the housing market and economic trends. If rates are dropping, it might be a good time to buy or refinance.

- Be Prepared: Gather all your financial documents before you start the application process. This will make things go smoother and faster.

- Ask Questions: Don't be afraid to ask your lender about anything you don't understand. They're there to help, and it's their job to make sure you're fully informed.

Remember, getting a mortgage is a big deal. Take your time, do your research, and don't be afraid to ask for help if you need it.

Conclusion: Making the Right Choice for Your Future

So there you have it—everything you need to know about Chase mortgage rates. Whether you're buying your first home or refinancing an existing one, understanding how these rates work is key to making smart financial decisions. And while Chase is a great option, it's always a good idea to shop around and compare rates before making a final decision.

Before you go, here's a quick recap of the key points we covered:

- Chase mortgage rates are influenced by factors like credit score, down payment, loan type, and economic conditions.

- Compare Chase's rates to other lenders, but make sure you're comparing apples to apples.

- Take steps to secure the best rate possible, like boosting your credit score and saving for a bigger down payment.

And now it's your turn. Leave a comment below and let us know what you think. Are you planning to go with Chase for your mortgage? Or are you considering other options? Whatever you decide, we wish you the best of luck in your home-buying journey. Cheers!

Table of Contents

- What Exactly Are Chase Mortgage Rates?

- Why Should You Care About Chase Mortgage Rates?

- Factors That Affect Chase Mortgage Rates

- How Do Chase Mortgage Rates Compare to Other Lenders?

- Key Points to Consider When Comparing Rates

- Steps to Secure the Best Chase Mortgage Rate

- Common Questions About Chase Mortgage Rates

- Expert Tips for Navigating Chase Mortgage Rates

- Conclusion: Making the Right Choice for Your Future

- Destiny 2 Server Status Whats Up With Your Favorite Game

- Why The Euro Symbol Is More Than Just A Currency Marker

Chase Mortgage and Home Equity review Top Ten Reviews

25+ Chase bank mortgage rates BenHollyanne

Chase mortgage rates calculator AndrewXinyu