Chase Mortgage Pre Approval: Your Key To Unlocking Homeownership

Buying a home is one of the biggest financial decisions you’ll ever make, and Chase mortgage pre-approval can be your first step toward turning that dream into reality. Imagine walking into a real estate office with confidence, knowing exactly how much house you can afford. It’s not just about getting approved; it’s about securing the best rates and terms to make homeownership work for you. Whether you’re a first-time buyer or looking to upgrade, this process is crucial if you want to stay ahead of the game.

But let’s face it—mortgage pre-approval can feel like navigating a maze. You’ve got paperwork, credit scores, income statements, and all sorts of jargon flying around. That’s why we’re here to break it down for you. We’ll walk you through everything from what Chase mortgage pre-approval means to how it benefits you and how to ace the application process. This isn’t just about numbers—it’s about building a solid foundation for your future.

So grab a coffee, sit back, and let’s dive deep into the world of Chase mortgage pre-approval. By the end of this article, you’ll not only know what to expect but also how to maximize your chances of getting that coveted stamp of approval. Let’s get started!

- Nice Cruise Deals Your Ultimate Guide To Affordable Luxury On The High Seas

- Kaymbu Login Your Ultimate Guide To Simplify Parentteacher Communication

What Exactly Is Chase Mortgage Pre Approval?

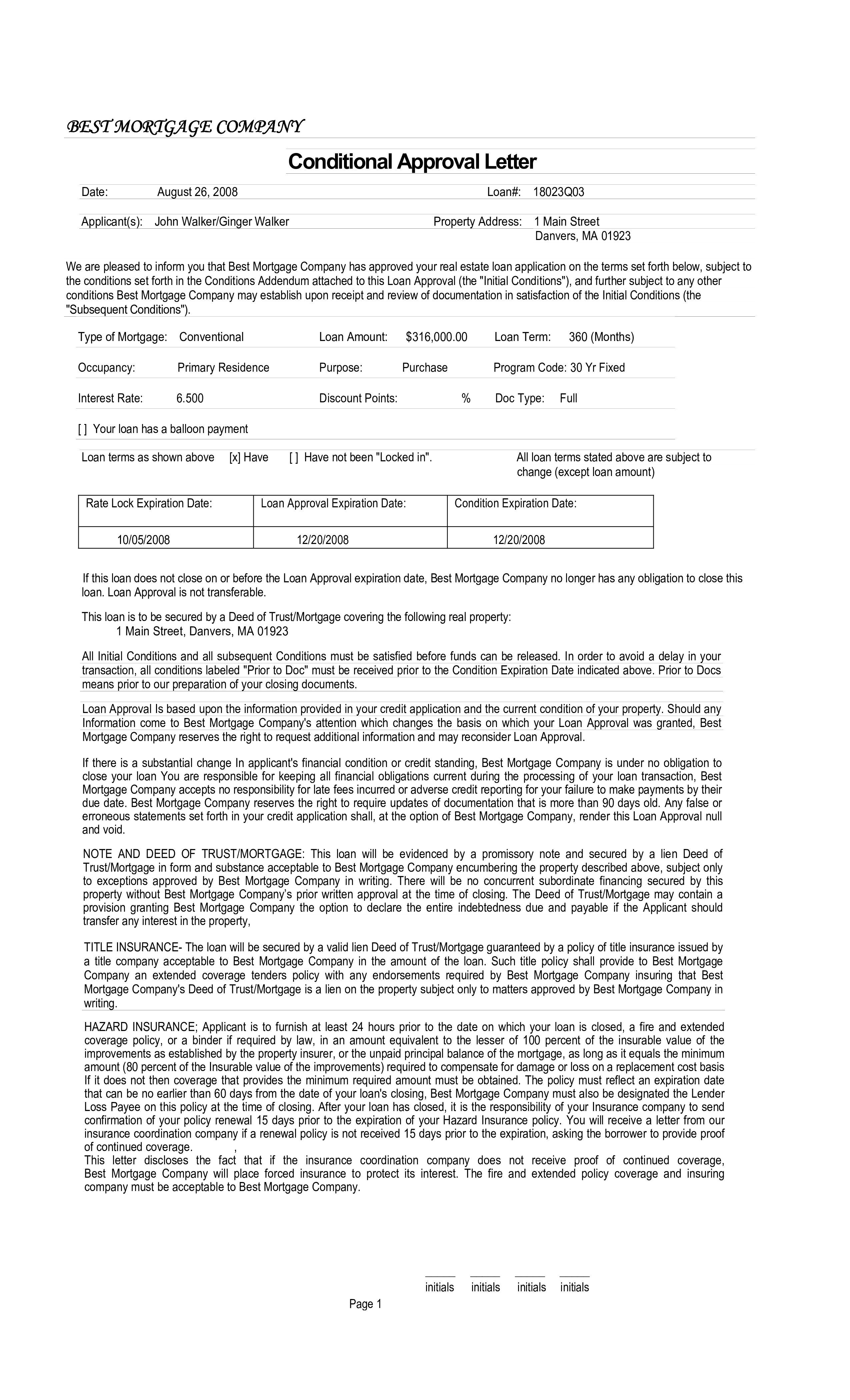

Let’s start by clearing up the basics. Chase mortgage pre-approval is essentially a lender’s way of saying, “Hey, based on what you’ve shown us so far, we think you’re a good candidate for a mortgage.” It’s like a trial run where Chase reviews your financial health—credit score, income, debts, and more—and gives you an estimate of how much they’d be willing to lend you for a home purchase. But here’s the kicker: it’s not a guarantee. Think of it as a handshake deal before signing the dotted line.

Now, why does this matter? Well, in today’s competitive housing market, having a pre-approval letter in hand makes you look like a serious contender. Sellers love it because it shows you’re financially prepared. Plus, it helps you set realistic expectations about your budget. No more dreaming about mansions when a cozy bungalow fits your wallet better!

Why Chase Mortgage Pre Approval Matters

Here’s the deal: Chase mortgage pre-approval isn’t just some optional step in the homebuying process—it’s essential. For starters, it gives you clarity. Instead of guessing how much house you can afford, you’ll have a clear number to guide your search. This means no wasted time looking at homes that are out of reach or settling for something less than ideal.

- Mastering The Art Of Euro Sign A Comprehensive Guide You Wonrsquot Want To Miss

- Is Destiny 2 Down The Ultimate Guide To Server Status Fixes And Everything You Need To Know

But wait, there’s more! A pre-approval letter also boosts your credibility with sellers and real estate agents. In a tight market, multiple buyers might be vying for the same property. Having that letter shows you’re serious and ready to move forward. It’s like wearing a power suit to a job interview—it gives you an edge.

Benefits Beyond the Basics

Beyond the obvious perks, Chase mortgage pre-approval offers some hidden advantages too. For one, it helps you lock in interest rates. If rates are favorable at the time of your pre-approval, Chase may offer you a rate lock, meaning you won’t get hit with higher rates later. And let’s be honest, saving even a fraction of a percentage point on a mortgage can add up to thousands over the life of the loan.

Plus, the pre-approval process gives you a chance to clean up your financial act. If Chase flags any issues—like high debt-to-income ratios or poor credit—you can address them early. That way, when it comes time to finalize the mortgage, you’re in the best possible position to negotiate favorable terms.

How Does Chase Mortgage Pre Approval Work?

Alright, now that we’ve established why Chase mortgage pre-approval is important, let’s talk about how it actually works. The process starts with gathering all your financial ducks in a row. Chase will want to see documents like pay stubs, tax returns, bank statements, and proof of assets. They’ll also pull your credit report to assess your creditworthiness.

Once they’ve reviewed everything, Chase will calculate your debt-to-income ratio and credit score to determine how much you qualify for. If everything checks out, they’ll issue a pre-approval letter stating the loan amount and terms. Keep in mind, though, that this letter typically expires after 90 days. So, you’ll want to use it while it’s still hot!

Steps to Get Pre-Approved

Ready to roll up your sleeves and get pre-approved? Here’s a quick breakdown of the steps:

- Gather necessary documents: Pay stubs, W-2s, tax returns, bank statements, and asset info.

- Check your credit score: A higher score improves your chances of better terms.

- Submit your application: You can do this online, over the phone, or in person at a Chase branch.

- Wait for approval: Chase usually processes applications within a few days.

- Receive your pre-approval letter: Keep it handy during your home search.

See? It’s not as scary as it sounds. Just remember, the more organized you are upfront, the smoother the process will go.

Common Misconceptions About Chase Mortgage Pre Approval

Let’s clear up a few myths floating around about Chase mortgage pre-approval. For starters, some people think it’s the same as pre-qualification. Not true! Pre-qualification is a quick, informal assessment based on self-reported info. Pre-approval, on the other hand, involves a thorough review of your finances. It’s like comparing a handshake to a signed contract.

Another misconception is that pre-approval locks you into working with Chase. Nope! While Chase will issue the pre-approval letter, you’re free to shop around for other lenders if you find better terms elsewhere. Just don’t forget to mention your Chase pre-approval—it gives you leverage in negotiations.

Myth vs. Reality

One last myth worth busting: pre-approval guarantees you’ll get the mortgage. Again, not exactly. Pre-approval is conditional on factors like maintaining your credit score and employment status until closing. If anything changes during that time, Chase may reassess your eligibility. But hey, as long as you play by the rules, you should be good to go.

Factors That Impact Chase Mortgage Pre Approval

So, what makes or breaks your chances of getting Chase mortgage pre-approval? Several factors come into play, and understanding them can help you stack the odds in your favor. First up is your credit score. Chase generally looks for a minimum score of 620, though higher scores can snag you better interest rates. Next is your debt-to-income ratio. Lenders prefer this to be below 43%, though exceptions exist.

Then there’s your employment history. Chase likes to see steady income over the past two years, either through a job or self-employment. Finally, your down payment amount matters. The more you put down, the less risky you appear to lenders. Aim for at least 20% to avoid private mortgage insurance (PMI).

Tips to Improve Your Chances

Feeling a little nervous about meeting these criteria? Don’t sweat it. Here are a few tips to boost your odds:

- Pay down existing debts to lower your DTI ratio.

- Dispute any errors on your credit report to improve your score.

- Save aggressively for a larger down payment.

- Stay employed in the same role until after closing.

Small changes now can make a big difference later. Trust us, it’s worth the effort!

Chase Mortgage Pre Approval vs. Other Lenders

Now, you might be wondering how Chase stacks up against other lenders when it comes to pre-approval. The truth is, Chase has some unique advantages. For one, their online application process is user-friendly and efficient. Plus, as one of the largest banks in the U.S., they offer a wide range of mortgage products to fit different needs.

That said, it’s always smart to compare offers. Other lenders might offer lower rates or more flexible terms depending on your situation. Just be sure to read the fine print and factor in things like fees and customer service quality. After all, your mortgage is a long-term commitment—you want to choose wisely.

What Sets Chase Apart?

Here’s what makes Chase stand out in the pre-approval game:

- Strong reputation and nationwide presence.

- Competitive rates and flexible loan options.

- Seamless digital experience for applications.

- Excellent customer support to guide you through the process.

Of course, your mileage may vary depending on individual circumstances. But for many buyers, Chase checks all the right boxes.

How to Maximize Your Chase Mortgage Pre Approval

Alright, you’ve got your pre-approval letter—now what? The key is to use it strategically. Start by setting a realistic budget based on the loan amount Chase approved you for. Then, work with a real estate agent who understands the local market to find properties within that range. Remember, just because Chase says you can borrow X amount doesn’t mean you should max it out. Leave room for unexpected expenses and future financial goals.

Once you’ve found a home, act fast! Submit your pre-approval letter with your offer to show sellers you’re serious. And don’t forget to keep all your financial info up-to-date until closing day. Any changes in your credit, income, or employment could jeopardize the deal.

Pro Tips for Success

Here are a few final tips to help you nail the Chase mortgage pre-approval process:

- Start early—don’t wait until the last minute to apply.

- Be honest and transparent with Chase about your finances.

- Monitor your credit regularly leading up to closing.

- Shop around for other lenders but use your Chase pre-approval as leverage.

Follow these steps, and you’ll be well on your way to securing that dream home.

Conclusion: Take the First Step Toward Homeownership

There you have it—everything you need to know about Chase mortgage pre-approval. From understanding the basics to maximizing your chances of success, this process is all about preparation and strategy. Remember, pre-approval isn’t just a formality—it’s a powerful tool that puts you in the driver’s seat during your home search.

So, what are you waiting for? Head over to Chase’s website or visit a local branch to kickstart your journey. And while you’re at it, share this article with friends or family who might find it helpful. After all, knowledge is power—and the more people who understand this process, the better off we all are.

Got questions or comments? Drop them below, and let’s keep the conversation going. Happy house hunting, and here’s to building the home of your dreams!

- Lawrence Wong Actor The Rising Star You Need To Know About

- How Many Blimps In The World A Skyhigh Exploration

Mortgage Preapprovals

NecolGurveer

Chase PreApproval Mortgage Your Ultimate Guide To Securing Your Dream