Chase Home Loans: Your Ultimate Guide To Securing Your Dream Home

Buying a home is one of the biggest financial decisions you'll ever make, and Chase Home Loans can be your trusted partner in this journey. Whether you're a first-time buyer or looking to refinance, Chase offers a wide range of mortgage options tailored to your needs. But before you dive in, it's crucial to understand what Chase Home Loans can offer and how they work. Let's break it down for you in simple terms.

Let’s face it, buying a house isn’t just about picking out the perfect kitchen or backyard. It’s a serious financial commitment, and having the right mortgage is key to making it work. Chase Home Loans has been helping millions of people across the U.S. secure their dream homes, and they’ve got all sorts of options for different lifestyles and budgets. But don’t just jump in blindly—there’s a lot to consider before you sign on the dotted line.

In this guide, we’ll walk you through everything you need to know about Chase Home Loans, from their types of mortgages to how to qualify and even tips to help you save money along the way. So whether you're a first-time homebuyer or looking to refinance, buckle up because we're about to demystify the world of home loans!

- Chicagos Best Rooftop Dining The Ultimate Guide To Skyhigh Eats

- Cheap Nice Cruises Discover The Best Affordable Luxury Voyages

What Are Chase Home Loans?

Alright, let’s start with the basics. Chase Home Loans are mortgage products offered by JPMorgan Chase, one of the biggest banks in the U.S. These loans are designed to help you buy or refinance a home, and they come in various shapes and sizes to fit different financial situations. Whether you're looking for a fixed-rate mortgage, adjustable-rate mortgage, or even a jumbo loan, Chase has got you covered.

But why choose Chase? Well, for starters, they’ve been in the game for a long time and have a solid reputation. Plus, they offer competitive rates, flexible terms, and a bunch of tools to make the home-buying process easier. And hey, if you’re already a Chase customer, you might even get some perks or discounts!

Types of Chase Home Loans

Now that we know what Chase Home Loans are, let’s dive into the different types they offer. Here’s a quick rundown:

- Rooftop Nightclub Nyc Where The Skyline Meets The Party Scene

- Joealis Filippetti The Rising Star Shaping The Future Of Entertainment

- Fixed-Rate Mortgages: These come with a set interest rate for the life of the loan, which makes budgeting a breeze.

- Adjustable-Rate Mortgages (ARMs): These start with a lower interest rate that can change over time, making them ideal for short-term plans.

- FHA Loans: Backed by the Federal Housing Administration, these are great for first-time buyers or those with lower credit scores.

- VA Loans: Designed for veterans and active military personnel, these often come with no down payment required.

- Jumbo Loans: For those looking to buy more expensive homes, these loans exceed the limits of conventional mortgages.

How to Qualify for Chase Home Loans

Qualifying for a Chase Home Loan isn’t as scary as it sounds. Sure, there are some requirements, but if you’ve got your financial ducks in a row, you’re good to go. Here’s what Chase typically looks for:

- Credit Score: Generally, you’ll need a minimum credit score of around 620, though some loans, like FHA loans, may accept lower scores.

- Debt-to-Income Ratio (DTI): Your DTI should ideally be below 43%, but Chase may allow higher ratios depending on your situation.

- Down Payment: This varies depending on the type of loan, but expect to put down anywhere from 3% to 20% of the home’s value.

- Employment History: Chase usually likes to see at least two years of steady employment.

Remember, these are just general guidelines. Your specific situation might vary, so it’s always a good idea to talk to a Chase loan officer to get personalized advice.

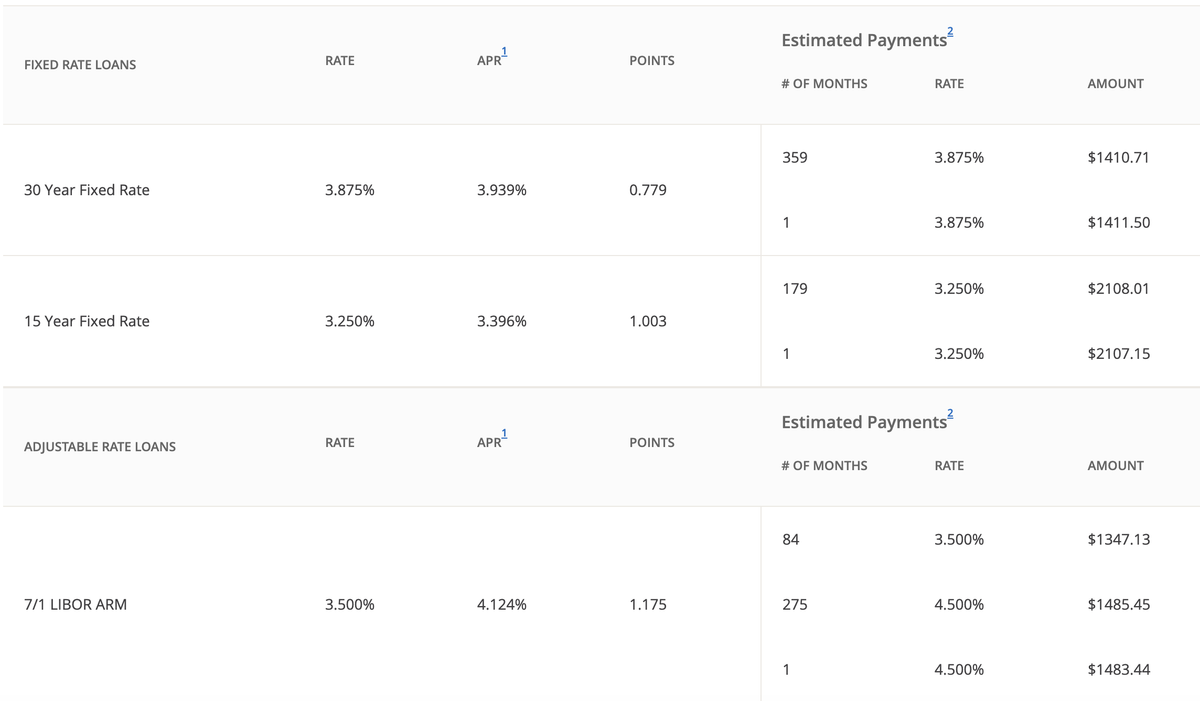

Chase Home Loans Rates

Everyone wants to know about the rates, right? Chase Home Loan rates depend on a bunch of factors, including the type of loan, your credit score, and current market conditions. As of 2023, fixed-rate mortgages typically range from 5% to 7%, while ARMs might start lower but can increase over time.

One cool thing about Chase is that they offer rate-lock guarantees, meaning once you lock in your rate, it won’t change during the loan process. And if you’re an existing Chase customer, you might even snag a discount on your rate—score!

Steps to Apply for Chase Home Loans

So, you’re ready to apply for a Chase Home Loan. Here’s how you do it:

- Pre-Approval: Start by getting pre-approved. This gives you an idea of how much you can borrow and shows sellers you’re serious.

- Gather Documents: You’ll need to provide proof of income, tax returns, bank statements, and other financial info.

- Choose Your Loan: Work with a Chase loan officer to pick the right mortgage for your needs.

- Submit Your Application: You can apply online or in person, and Chase will review your application.

- Close the Deal: Once approved, you’ll go through the closing process, sign the paperwork, and voila—you’re a homeowner!

Pro tip: Make sure you read all the fine print and ask questions if anything seems unclear. Knowledge is power, my friend!

Chase Home Loans Calculator

Before you apply, it’s smart to use a Chase Home Loan calculator to estimate your monthly payments. This tool takes into account your loan amount, interest rate, down payment, and other factors to give you a rough idea of what you’ll be paying each month. It’s a great way to see if the numbers work for your budget.

Just head over to Chase’s website, plug in your info, and let the calculator do the math for you. Easy peasy!

Benefits of Chase Home Loans

Why should you choose Chase Home Loans over other lenders? Here are some compelling reasons:

- Competitive Rates: Chase offers some of the best rates in the industry, which can save you thousands over the life of your loan.

- Flexible Options: With a variety of mortgage types, Chase can accommodate just about any financial situation.

- Customer Support: Chase has a dedicated team of loan officers ready to guide you through every step of the process.

- Convenience: You can apply online, check your loan status, and manage your account all from one place.

Plus, if you’re already part of the Chase family, you might get additional perks, like discounts or rewards points.

Chase Home Loans Customer Reviews

What do real people have to say about Chase Home Loans? Overall, the reviews are pretty positive. Many customers appreciate the ease of application, competitive rates, and helpful customer service. However, like with any lender, there are occasional complaints about slow processing times or communication issues.

The key is to do your research and make sure Chase is the right fit for you. Read reviews, ask questions, and don’t be afraid to shop around before making a decision.

Chase Home Loans vs. Other Lenders

How does Chase stack up against other mortgage lenders? Let’s compare:

- Bank of America: Similar rates and options, but Chase might have better customer service.

- Wells Fargo: Both offer competitive products, but Chase’s online tools might give them an edge.

- Quicken Loans: Known for their fast closings, but Chase might offer more personalized service.

Ultimately, the best lender for you depends on your specific needs and preferences. It’s always a good idea to compare multiple options before making a choice.

Chase Home Loans Refinancing

Already have a mortgage but want to refinance? Chase offers refinancing options that can help you lower your monthly payments, switch to a different type of loan, or even cash out some equity. Just like with new loans, you’ll need to qualify, but if you’ve improved your credit score or the value of your home has increased, you might be in luck.

Pro tip: Use a Chase refinance calculator to see if refinancing makes sense for you financially.

Tips for Getting the Best Chase Home Loan

Want to maximize your chances of getting the best Chase Home Loan? Here are some insider tips:

- Boost Your Credit Score: Even a small increase can get you better rates.

- Save for a Larger Down Payment: This can reduce your monthly payments and possibly eliminate private mortgage insurance (PMI).

- Shop Around: Compare Chase’s rates and terms with other lenders to ensure you’re getting the best deal.

- Be Honest About Your Finances: Full disclosure upfront can save headaches later.

Remember, buying a home is a marathon, not a sprint. Take your time, do your research, and don’t hesitate to ask for help when you need it.

Common Questions About Chase Home Loans

Got questions? We’ve got answers. Here are some FAQs about Chase Home Loans:

- Q: Can I apply for a Chase Home Loan online? A: Yes, you can apply online or in person.

- Q: Do I need a certain credit score to qualify? A: While it varies by loan type, a score of 620 or higher is generally recommended.

- Q: What documentation do I need to provide? A: Expect to supply proof of income, tax returns, bank statements, and other financial info.

Still unsure? Reach out to a Chase loan officer for personalized guidance.

Final Thoughts

Buying a home is a big deal, and having the right mortgage partner can make all the difference. Chase Home Loans offer a wide range of options, competitive rates, and excellent customer service, making them a top choice for many homebuyers. But remember, it’s important to do your homework, compare options, and make sure you’re getting the best deal possible.

So what are you waiting for? Whether you’re ready to apply or just want to learn more, Chase has got the tools and expertise to help you secure your dream home. And hey, don’t forget to celebrate once you’ve signed those papers—you’ve earned it!

Now it’s your turn. Have questions? Comments? Share your thoughts below or check out our other articles for more tips and insights. Happy house hunting!

Table of Contents

- What Are Chase Home Loans?

- Types of Chase Home Loans

- How to Qualify for Chase Home Loans

- Chase Home Loans Rates

- Steps to Apply for Chase Home Loans

- Benefits of Chase Home Loans

- Chase Home Loans vs. Other Lenders

- Tips for Getting the Best Chase Home Loan

- Common Questions About Chase Home Loans

- Final Thoughts

- Top 10 Skinniest Person In The World Unveiling Their Stories And Struggles

- Top Rooftop Restaurants In Chicago The Ultimate Guide To Skyhigh Dining

Apply for Chase Home Loan Online 2021 Chase Mortgage www.chase

Chase Mortgage and Home Equity review Top Ten Reviews

Chase Mortgage and Home Equity review Top Ten Reviews